50/30/20 rule India 2025: Beat inflation and make every rupee work harder by adopting a proven rupee-wise money management strategy. In an era marked by rising prices and shrinking purchasing power, the 50-30-20 budgeting formula offers an easy-to-follow framework that empowers salaried Indians to allocate their income effectively, safeguard savings, and keep lifestyle inflation in check. This simple yet powerful needs-wants-savings ratio not only aligns with personal finance tips for 2025 but also helps craft a budget plan for rising inflation without overcomplicating your financial life. Below, you will discover how to budget salary in India using the 50/30/20 rule, practical steps to manage every rupee, and actionable guidance to ensure smart spending and saving rule compliance in 2025.

Understanding the 50-30-20 Budgeting Formula

The 50/30/20 budgeting formula divides after-tax income into three broad categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. In India today, where inflationary pressures affect essentials such as groceries, utilities, and healthcare, having a disciplined framework is more critical than ever. By setting aside half of your salary for unavoidable expenses (rent, groceries, EMIs, and insurance premiums), you secure a stable financial foundation. Allocating 30% for discretionary spending (dining out, entertainment, shopping) ensures you enjoy life without overspending, while the remaining 20% fuels long-term goals, emergency fund buildup, retirement planning, or investments in mutual funds and equities.

Needs (50%): Essentials and Inflation-Proofing

When constructing a budget plan for rising inflation, categorising expenses accurately is vital. Needs encompass rent or mortgage, utility bills, groceries, transportation, insurance, and EMI payments. In 2025, inflation in India is expected to hover around 5–6%, affecting food and fuel costs. Monitoring price trends and renegotiating contracts (such as rent or subscription services) can mitigate inflation’s impact. For instance, if your monthly take-home pay is ₹50,000, you should allocate ₹25,000 to needs. If your current essential spending exceeds ₹25,000 due to inflation, you must identify non-negotiable vs. negotiable costs. Tracking expenses through digital apps or simple spreadsheets can reveal things like unused subscription services or underutilised amenities where you can cut back and stay within the 50% threshold.

Wants (30%): Balancing Lifestyle and Frugality

The 30% bucket covers discretionary expenses: dining out, travel, hobbies, entertainment subscriptions, and shopping sprees. In 2025, millennials and Gen Z in India value experiences but still need to be mindful of a shrinking rupee. A smart strategy is to set a monthly cap (₹15,000 if your income is ₹50,000) for such wants. Prioritise activities that deliver maximum joy per rupee; for example, choose off-peak travel, dine at cost-effective cafes, and explore free or low-cost community events. Use cashback apps and loyalty programmes to stretch your “wants” budget. By consciously spending on wants, you avoid emotional overspending and maintain a healthy balance between living in the moment and preserving funds for future goals.

Savings (20%): Guarding Against Uncertainty and Wealth Building

Saving at least 20% of your after-tax income (₹10,000 out of ₹50,000 in this example) forms the backbone of long-term financial security. In a high-inflation environment, parked cash loses value; therefore, it makes sense to allocate savings into inflation-beating instruments. Consider a blended approach: maintain an emergency fund equivalent to three to six months of needs in a high-yield savings account or liquid mutual fund, and direct the remainder into diversified equity-linked instruments like equity mutual funds, index funds, or systematic investment plans (SIPs). By automating investments through SIPs, you lock in the rupee-cost averaging advantage while cultivating a disciplined savings habit. Additionally, if you have high-interest debt (credit card balances or personal loans), funnel a portion of this 20% toward accelerated repayment to free up more disposable income in the future.

Table: 50-30-20 Allocation Breakdown (Assuming ₹50,000 Monthly Income)

| Category | Percentage of Income | Monthly Amount (₹) | Examples |

|---|---|---|---|

| Needs | 50% | 25,000 | Rent, groceries, utilities, EMI, insurance |

| Wants | 30% | 15,000 | Dining out, cinema, travel, subscriptions |

| Savings | 20% | 10,000 | Emergency fund, SIPs, retirement, debt repayment |

Budget Plan for Rising Inflation

A robust budget plan for rising inflation incorporates periodic reviews. Every quarter, revisit your needs allocation to account for changes in grocery prices, fuel costs, and housing rentals. If essentials creep above 50%, adjust your wants or savings buckets temporarily; ideally, cut back wants before hampering your savings. Use digital tools to compare grocery prices online, switch to generic brands where acceptable, and take advantage of bulk buying to minimise cost per unit. For utilities, adopt energy-efficient appliances, unplug devices, and optimise water usage to reduce bills. These personal finance tips for 2025 ensure that while inflation bites, you remain within the 50/30/20 framework without derailing your long-term objectives.

How to Budget Salary in India with the 50-30-20 Rule

Step 1: Calculate After-Tax Income. Identify your net salary after all statutory deductions (PF, professional tax, TDS).

Step 2: Automate Allocations. Set up standing instructions in your bank account to transfer 50% to a checking or primary savings account (for needs), 30% to a designated debit account or digital wallet (for wants), and 20% to an investment or debt repayment account.

Step 3: Track Daily Expenses. Use a simple spreadsheet or mobile budgeting app to log every expense tagged under “needs” or “wants” to ensure you don’t overshoot.

Step 4: Automate Savings. Schedule monthly transfers to SIPs, retirement funds (PPF, NPS), or debt repayment to enforce discipline.

Step 5: Monthly Review. At the end of each month, reconcile actual spending against allocated amounts; if you consistently underspend on wants, consider reallocating surplus to savings or investing in a short-term fixed deposit to combat inflation.

Personal Finance Tips 2025: Maximizing the 50/30/20 Rule

• Use Technology to Your Advantage: Budgeting apps like Money View, Walnut, or Splitwise can categorise expenses in real time, alerting you when you approach limits.

• Prioritise High-Interest Debt: If you carry credit card balances or personal loans at double-digit rates, allocate a portion of your savings bucket toward elimination first; reducing debt yield on your money is the best “investment” in an inflationary environment.

• Build an Emergency Corpus: Aim to amass three months’ worth of “needs” in a liquid instrument. An emergency fund guards against job loss or medical emergencies, ensuring you don’t derail other buckets.

• Revisit Insurance Coverages: Inflation erodes the real value of insurance. In 2025, ensure your health insurance and term insurance coverages keep pace with rising healthcare and lifestyle costs.

• Adopt a Frugal Mindset for Wants: Look for free or low-cost entertainment options. Instead of dining out weekly, try cooking at home and hosting potlucks with friends. Explore online streaming services that offer family plans or region-specific pricing.

• Automate SIP Top-Ups: As your salary grows, increase your SIP contributions proportionally, maintaining the 20% savings ratio. This rupee-wise money management accelerates wealth creation over time.

Rupee-Wise Money Management in 2025

The Indian rupee remains susceptible to global commodity cycles and domestic demand-supply dynamics. To navigate fluctuations, consider the following strategies:

– Diversify Savings Instruments: Instead of parking all savings in bank fixed deposits, which may yield 6–7% (below inflation), split between liquid funds, short-term debt funds, and equity funds.

– Explore Gold via Digital Routes: With international price volatility, allocate up to 5% of savings to digital gold or sovereign gold bonds to hedge against inflation.

– Leverage Systematic Transfer Plans (STPs): Shift excess liquidity from debt funds to equity funds gradually, ensuring rupee-cost averaging and reduced market timing risks.

– Review Allocation Annually: If your salary increases, recalculate the 50/30/20 buckets, adjusting absolute rupee amounts to maintain purchasing power and save more aggressively.

Smart Spending and Saving Rule Implementation

To internalise the smart spending and saving rule, follow these actionable steps:

-

Zero-Based Budgeting for Discretionary Spending: At the start of each month, list all potential wants (streaming subscriptions, dining out, weekend trips) and assign a monetary cap. Once your 30% quota is exhausted, avoid further discretionary spending until next month.

-

Bulk Purchase Non-Perishables: Buy staples like rice, lentils, and oil during discount seasons or via bulk deals to save rupees per unit.

-

Use Cashback and Rewards: Pay routine bills (mobile recharge, groceries, utility bills) through platforms offering cashback or reward points. Redeem these points toward your wants bucket to stretch lifestyle spending.

-

Opt for Shared Mobility: Rather than owning a second vehicle or using ride-hailing for every commute, explore carpooling or public transit options for cost-effective travel.

-

Track ROI on Wants: Before spending on an expensive gadget or luxury holiday, estimate the rupee-per-joy ratio. If a ₹20,000 trip yields more lasting satisfaction than a ₹15,000 gadget, allocate accordingly; this thought process prevents impulsive buys that do not align with long-term goals.

Staying Accountable and Adjusting for 2025 Realities

Rising inflation and shifting economic policies mean that the 50-30-20 rule should be a living template, not a rigid mandate. By reviewing your budget plan for rising inflation every six months, you can adjust the needs-wants-savings ratio. For instance, if essential costs spike to 55% of income, temporarily reduce wants to 20% and maintain savings at 20% until prices stabilise. Conversely, if no major inflationary shocks occur, consider boosting savings to 25% by trimming wants to 25%. The adaptability of this personal finance framework ensures that budgeting remains realistic and responsive to macroeconomic changes.

By implementing the 50/30/20 budgeting formula in 2025, Indians can effectively manage their salary, protect against inflation, and build a foundation for long-term financial well-being. Aligning rupee-wise money management with the needs-wants-savings ratio helps individuals maintain financial discipline, reduce stress, and invest in future growth opportunities. Use these guidelines to budget salary in India, apply smart spending and saving rule tactics, and leverage personal finance tips in 2025 to make every rupee work harder.

“With grocery bills up 7.3% and rent up 9% in India this year, the way you budget today decides your wealth tomorrow.” Incorporating the 50/30/20 rule India 2025 provides a simple yet powerful 50-30-20 budgeting formula to tackle inflation. Defined as allocating after-tax income into 50% needs, 30% wants, and 20% savings, this needs-wants-savings ratio offers rupee-wise money management and smart spending and saving rule guidance. In this article, you’ll discover inflation-proof buckets, salary-wise examples, automation hacks, and FAQs to help you learn how to budget salary in India. Don’t miss the quick-answer boxes and downloadable cheat sheet (snippet bait) to supercharge your budget plan for rising inflation and apply personal finance tips in 2025 effectively.

Quick-Answer Box – “What Is the 50/30/20 Rule?”

-

50% needs (essentials)

-

30% wants (lifestyle)

-

20% savings/investments

Why the 50/30/20 Rule Matters in 2025

Rising consumer price index (CPI) and lifestyle inflation in India have made it more challenging to stretch rupees. As grocery bills climb by over 7.3% and rent by 9%, a rigid zero-based budget can feel outdated. The 50/30/20 rule in India 2025 provides flexibility, enabling you to adjust each bucket when costs surge. While needs (50%) cover essentials such as rent and groceries, wants (30%) and savings (20%) can flex around inflationary shocks without derailing overall financial goals.

Stagnant wage growth versus the rapidly increasing cost of living has widened the gap between take-home pay and expenses. By adhering to a needs-wants-savings ratio, you prevent essentials from absorbing your entire salary. This rule ensures that even when income fails to keep pace with inflation, at least 20% of after-tax income is earmarked for savings or debt pre-payment, preserving long-term wealth growth.

Flexibility is a core advantage of the 50-30-20 budgeting formula compared to zero-based budgets, which demand exact line-item tracking each month. When an unexpected expense, like a sudden medical bill or vehicle repair, pushes needs above 50%, you can temporarily reduce wants from 30% to 20% to maintain savings. Conversely, if essential costs drop, you can allocate surplus toward higher savings or discretionary goals.

However, the 50/30/20 rule can fail in situations of very high EMIs or volatile gig income. For salaried individuals with EMIs that exceed 40% of their salary, the 50% “needs” bucket may be insufficient, forcing an oversized allocation for debt repayment. Similarly, freelancers or gig workers with irregular, unpredictable cash flows may struggle to allocate a consistent 20% toward savings every month. In such cases, consider modifying the rule temporarily, such as prioritising high-interest debt or building a larger cash buffer until income stabilises.

Decoding the Three Buckets

| Bucket | Typical Items (India 2025) | Rule of Thumb Checks |

|---|---|---|

| Needs 50 % | Rent, EMIs, groceries, insurance, utilities | “Would life halt without it?” |

| Wants 30 % | Streaming, dining-out, travel EMIs, subscriptions | “Could I delay it 30 days?” |

| Savings: 20% | Emergency fund, SIPs, debt pre-pay, PPF | “Does it grow my net worth?” |

Step-by-Step Guide: How to Apply the Rule

Step 1 – Calculate True Take-Home (Post-Tax, Post-EPF)

Before dividing your income into 50/30/20 buckets, determine the actual amount you receive each month after all statutory deductions. Start with your gross salary and subtract:

-

Income Tax (TDS): The amount withheld by your employer based on your projected annual income and applicable tax slabs.

-

Employee Provident Fund (EPF): The monthly contribution you make toward your retirement fund (typically 12% of basic pay).

-

Professional Tax or Other Deductions: Some states in India levy a small professional tax; additionally, account for any insurance premiums, union fees, or other mandatory withholdings.

The result is your true “net take-home” pay. For example, if your gross salary is ₹50,000 and you pay ₹5,000 in TDS, ₹6,000 in EPF, and ₹500 in professional tax, your monthly take-home is:

Use this ₹38,500 as the base for all subsequent allocations instead of the ₹50,000 gross figure.

Step 2 – Use the Free Online 50/30/20 Calculator

To simplify allocating your net take-home into the three buckets, use a dedicated 50/30/20 calculator available on personal finance sites. For instance, NerdWallet (nerdwallet.com) offers a straightforward web tool:

-

Open the Calculator Page: Navigate to the 50/30/20 budgeting calculator on NerdWallet’s website.

-

Enter Your Net Take-Home Amount: Type the figure you computed in Step 1 (e.g., ₹38,500).

-

View the suggested splits: The calculator instantly breaks down your take-home pay into:

-

50% for needs (₹19,250)

-

30% for wants (₹11,550)

-

20% for savings/investments (₹7,700)

-

Step 3 – Automate Transfers (SIPs, Recurring Deposits, UPI Standing Instructions)

Once you know exactly how much to allocate to each bucket, set up automatic transfers so you never have to remember the split manually:

-

Savings Bucket (20%):

-

Open your bank’s internet banking portal or mobile app.

-

Create a Recurring Deposit (RD) for the 20% portion, or set up a Systematic Investment Plan (SIP) in an equity/debt mutual fund for rupee-cost averaging.

-

Schedule these transfers on the same day your salary clears. This ensures your savings are parked before you spend.

-

-

Needs Bucket (50%):

-

If you have fixed monthly obligations (rent, EMIs, insurance premiums), use UPI standing instructions or auto-debit mandates so these payments execute automatically on their due dates.

-

Leave the remainder of the “Needs” allocation in your primary checking/savings account to cover groceries, utilities, fuel, and groceries.

-

-

Wants Bucket (30%):

-

Open a separate savings account or create a virtual wallet in your banking app.

-

Set up a UPI standing instruction that moves 30% of your net take-home directly into that account every month.

-

Use this dedicated account only for discretionary expenses (dining out, streaming subscriptions, travel bookings) to avoid accidentally dipping into other buckets.

-

By automating all transfers, you enforce discipline: 20% immediately moves into long-term investments, 50% stays earmarked for true essentials, and 30% is locked for lifestyle spending.

Step 4 – Track & Review Every Quarter (Spreadsheet / YNAB / Moneyfy)

Even with automation, periodic reviews ensure you stay on track and adjust for any changes:

-

Choose a Tracking Tool

-

Spreadsheet: Create a simple Google Sheets or Excel file with columns for each bucket (needs, wants, savings) and rows for actual vs. budgeted amounts. Use formulas to calculate variances and highlight overruns in red.

-

YNAB (You Need a Budget): This paid tool lets you assign every rupee to a category and import transactions from your bank account and tag each expense as a “Need” or “Want”. YNAB’s real-time tracking shows how much of each bucket remains.

-

Moneyfy: An Indian-focused budgeting app that links to your UPI or bank account; it categorises transactions automatically and displays pie charts for your 50/30/20 split.

-

-

Set a Quarterly Reminder

-

On the first working day of each quarter (e.g., April 1, July 1, October 1, January 1), block 30 minutes in your calendar to review the past three months.

-

-

Compare Actual vs. Budgeted

-

Needs: Sum up all expense categories labelled as essentials. Did they stay within 50% of net take-home? If grocery or utility costs spiked, note how far they exceeded.

-

Wants: Total all discretionary spending (dining, entertainment, shopping). Check whether you kept it under 30%. If you overran, identify which category (e.g., travel) caused the overshoot.

-

Savings: Confirm that at least 20% went into SIPs, RDs, or debt payments every month. If any month fell short, perhaps due to an emergency withdrawal, plan how to catch up by increasing next quarter’s SIP amount.

-

-

Adjust for Changes

-

Salary Revision: If you receive a raise or bonus, recalculate the exact 50/30/20 amounts on your new net take-home. Then update your UPI standing instructions or RD/SIP mandates.

-

Inflationary Shifts: If rent, EMIs, or utility bills rise sharply, push nonessential spending (wants) down or temporarily adjust to a 60/25/15 split until costs stabilise.

-

Goal Reprioritisation: If you decide to pay off a high-interest loan faster, allocate part of the “Savings” bucket to extra EMI payments, reducing long-term interest outgo.

-

By following these four steps – accurately calculating take-home pay, using an online calculator, automating each allocation, and conducting quarterly reviews – you ensure your 50/30/20 budgeting formula remains both realistic and adaptable over time. This systematic approach lets you manage inflation, automate savings, and maintain a disciplined spending plan without constant manual intervention.

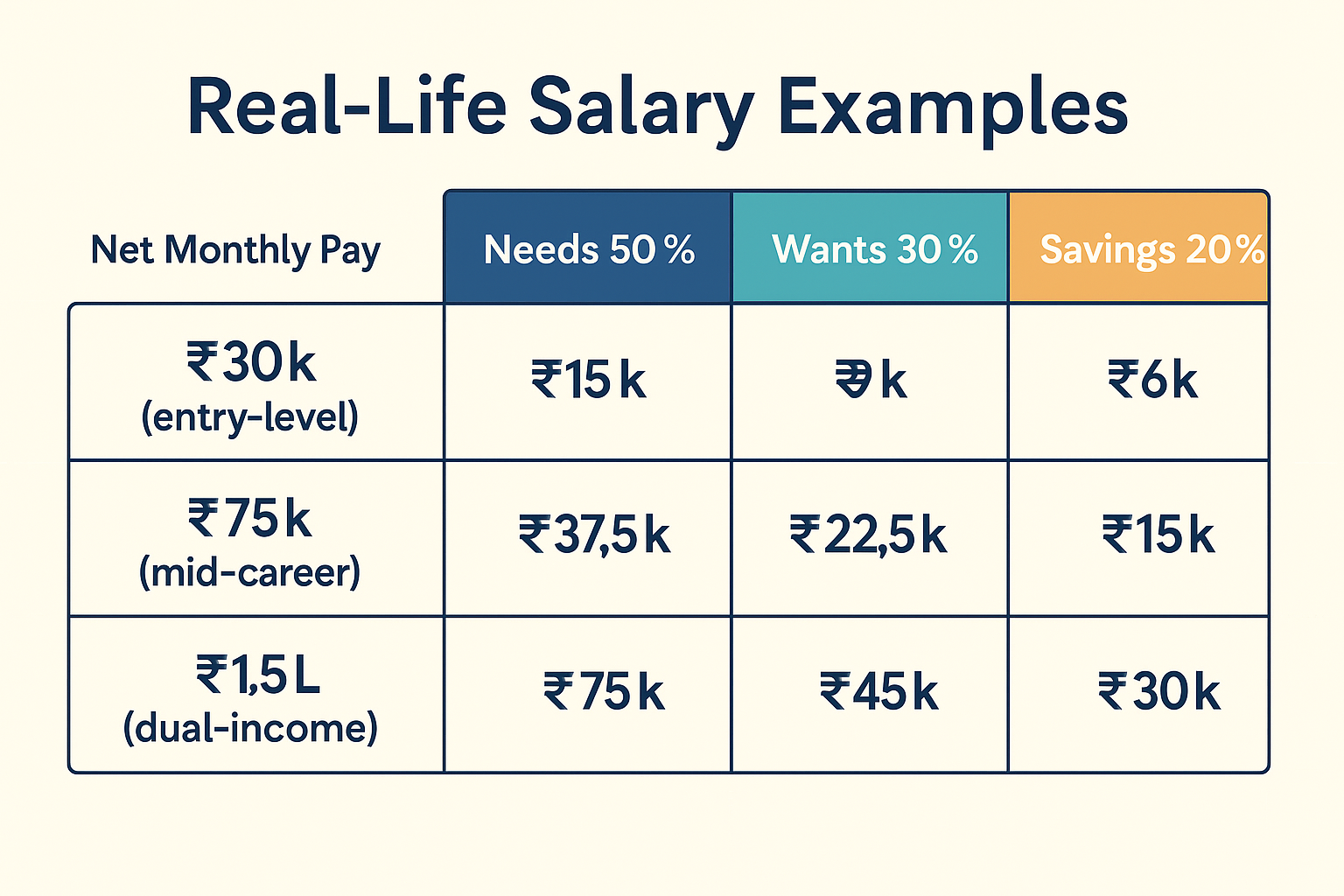

Real-Life Salary Examples (Snippet-Friendly Tables)

| Net Monthly Pay | Needs 50 % | Wants 30 % | Savings: 20% |

|---|---|---|---|

| ₹30 k (entry-level) | ₹15 k | ₹ 9 k | ₹ 6 k |

| ₹75 k (mid-career) | ₹ 37.5 k | ₹ 22.5 k | ₹ 15 k |

| ₹1.5 L (dual-income) | ₹ 75 k | ₹ 45 k | ₹ 30 k |

“₹ 5,000/mo can snowball to ₹ 7.8 L in 10 years @ 8 % SIP.”

Adjusting the Rule for High Inflation

When necessities exceed 50% of after-tax income, slide to a temporary allocation such as:

| Original Bucket | Adjusted Bucket (Option 1) | Adjusted Bucket (Option 2) |

|---|---|---|

| Needs 50 % | Needs 60 % | Needs 70 % |

| Wants 30 % | Wants 25 % | Wants 20 % |

| Savings: 20% | Savings: 15% | Savings: 10% |

Increase the “wants” bucket only if salary growth outpaces inflation to guard against lifestyle creep. Always keep savings at or above 20% by reducing discretionary spending rather than cutting essentials.

Alternatives & Hybrids

| Alternative/Hybrid | Context/Description |

|---|---|

| 70-20-10 Rule | High-cost metros |

| Zero-Based Budget | Every rupee assigned |

| Pay-Yourself-First | 20% skim off top, then 80 % flexible |

| FIRE Variant (50-20-30 Rule) | Aggressive wealth builders |

8 Common Mistakes & How to Avoid Them

-

Counting EMIs as “wants”. Treating equated monthly installments (EMIs) for car loans, personal loans, or credit cards as discretionary spending inflates the wants bucket and skews your needs-wants-savings ratio.

How to avoid: Classify all mandatory loan payments under the “needs” category. EMIs are non-negotiable obligations; track them alongside rent, groceries, and utilities to ensure your essential expenses stay within 50%. -

Using gross salary, not net. Budgeting based on gross (pre-tax and pre-EPF) income overestimates the funds available for distribution, leading to overspending or under-saving each month.

How to avoid: Calculate true take-home pay by subtracting taxes (TDS), Employee Provident Fund (EPF), professional tax, and any other statutory deductions. Apply the 50 / 30 / 20 splits only to this net figure so each bucket reflects real spendable income. -

Ignoring annual bonuses. Failing to incorporate one-time bonuses, performance-based incentives, or festival bonuses into your 50 / 30 / 20 framework leaves money idle or misallocated, hindering both emergency-fund growth and investment potential.

How to avoid: Treat bonuses as “extra” income. Immediately allocate at least 20% of any bonus to your savings/investments bucket, whether that’s a lump-sum SIP, an additional PPF contribution, or a top-up to your emergency fund, to maintain momentum on financial goals. -

No emergency fund before investing. Jumping straight into SIPs or long-term investments without a liquid buffer leaves you vulnerable to sudden expenses (medical emergencies, job loss) and may force you to liquidate investments at a loss.

How to avoid: Before deploying 20% of your income to equities or debt instruments, build an emergency fund equal to three to six months’ worth of “needs” expenses in a liquid account (high-yield savings or liquid mutual fund). This ensures you won’t disrupt your long-term strategy. -

Mixing short-term goals with long-term savings. Parking all of the 20% savings bucket into long‐duration instruments (equity funds, PPF) without earmarking money for short-term objectives (vacation, appliance purchase) can lead to premature withdrawals or penalty fees.

How to avoid: Subdivide your 20% savings bucket into subcategories: Maintain at least one-third in liquid or short-term debt funds for 1- to 3-year goals, and allocate the remainder to long-term SIPs, PPF, or NPS. This preserves liquidity for near-term needs. -

Not adjusting for inflationary shocks. Sticking rigidly to 50 / 30 / 20 when necessities suddenly climb above 50% (fuel spikes, rent hikes, grocery inflation) can force you to raid your savings or disrupt your budget entirely.

How to avoid: If needs exceed 50% for more than one month in a quarter, temporarily shift to a 60/25/15 or 70/20/10 allocation, prioritising essential costs while consciously planning to restore the standard 20% savings bucket as soon as prices stabilise or income increases. -

Overlooking irregular or gig income. Freelancers, consultants, and gig workers often face fluctuating monthly cash flows. Applying a fixed 50 / 30 / 20 split without accounting for variability can result in underfunded buckets or overspending.

How to avoid: Determine a conservative “base salary” equivalent (for example, the lowest‐earning month in the past year) as your anchor. Apply the 50 / 30 / 20 percentages to that baseline. Any surplus in high‐income months should be funnelled into boosting your savings bucket or prepaying debt. -

Skipping quarterly reviews. Failing to revisit your allocations every three months means missing signals for necessary adjustments, such as changes in rent, utility bills, or salary hikes, which ultimately derails long-term goals.

How to avoid: Schedule a brief budget audit each quarter using a spreadsheet or budgeting app (YNAB, Moneyfy, or a simple Google Sheets template). Compare actual spending vs. allocated amounts, identify bucket overruns or underruns, and recalibrate the next quarter’s allocations accordingly.

FAQ – People Also Ask Corner

| Question (H3) | 2-Sentence SEO Answer |

|---|---|

| Is the 50/30/20 rule realistic in Mumbai or Bengaluru? | A 2025 RBI survey shows median rent plus EMIs in Tier-1 cities can cross 55% of income; tweak to 60-25-15 but restore 20% savings within a year. |

| Should EMIs fall under needs or savings? | Minimum loan payment = need; extra prepayment = savings. |

| How often should I revise my ratios? | Quarterly or whenever the salary changes ± 10%. |

| Can I invest the ‘20%’ entirely in equity SIPs? | Yes, if your emergency fund equals six months’ expenses; otherwise, build cash first. |

| How does 50/30/20 compare with zero-based budgeting? | Zero-based budgeting assigns every rupee to a specific line item; 50/30/20 uses broad buckets faster but less granularly. |