A Permanent Account Number (PAN) card is much more than a mandatory document for filing income tax returns. Issued by the Income Tax Department of India, a PAN card is a unique 10-character alphanumeric identifier that serves as your financial passport in numerous transactions. While most Indians associate their PAN card primarily with tax compliance, this powerful tool unlocks a host of hidden benefits—from seamless banking and loan approvals to smarter investment pathways and NRI-specific conveniences.

In this comprehensive, 3,000-word pillar article, you will discover why every Indian needs a PAN card, how to leverage its lesser-known advantages, and step-by-step guidance on application, linkage, and strategic usage. You will learn to follow the law and improve your finances.

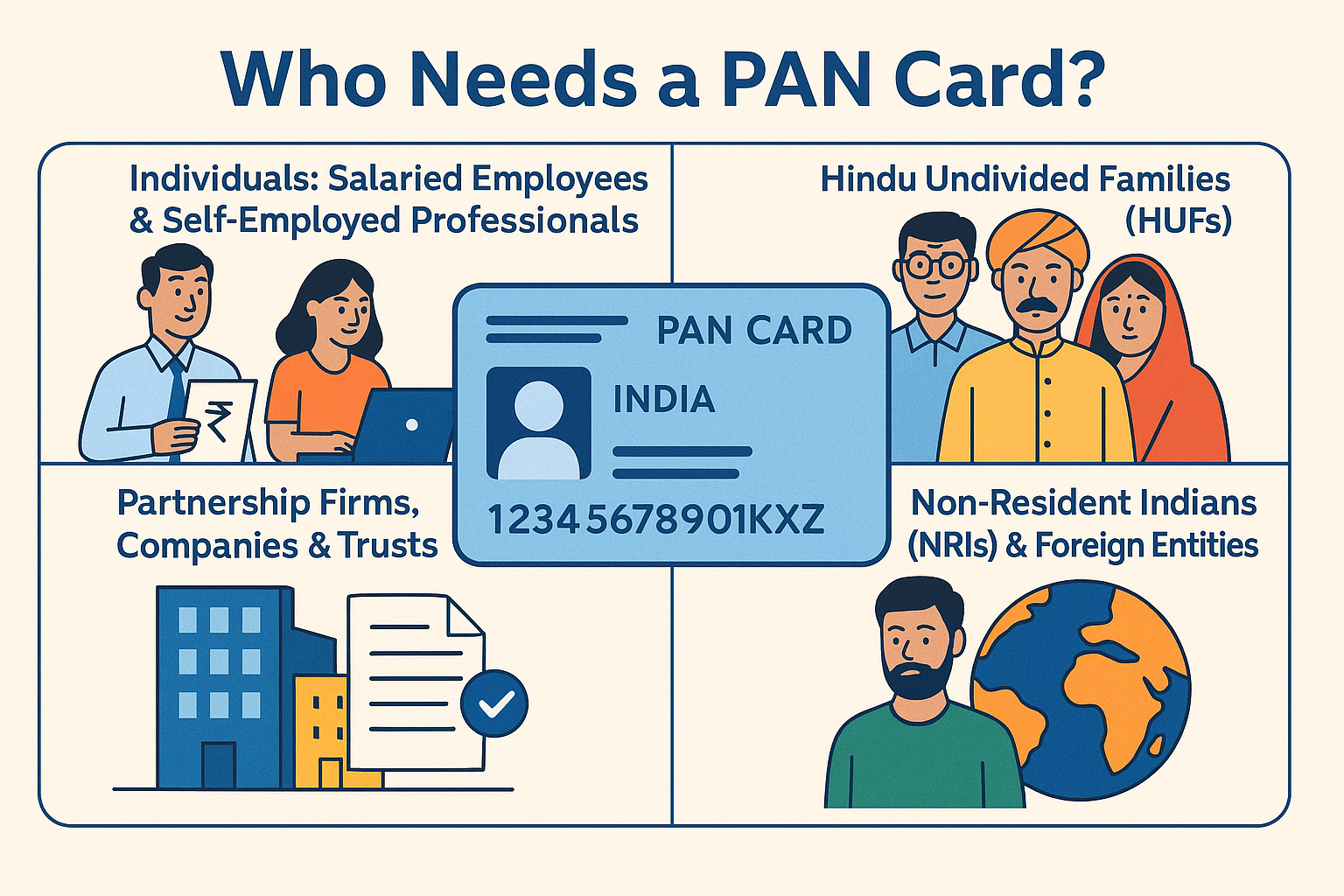

Who Needs a PAN Card?

Indian Residents

The PAN card is essential for various individuals and entities in India who engage in financial and taxation-related activities. Key categories include

Individuals: Salaried Employees and Self-Employed Professionals

-

Filing Income Tax Returns (ITR): Mandatory if income exceeds the basic exemption limit; PAN serves as the primary identifier.

-

Preventing Tax Evasion: Links all financial transactions to your tax profile.

-

High-Value Transactions: Required for property dealings, bank account openings, and investments in mutual funds and shares.

Hindu Undivided Families (HUFs)

-

Under Indian tax law, HUFs are recognised as separate taxable entities.

-

To file HUF income, conduct transactions, and adhere to regulatory requirements, one must obtain a PAN.

Partnership Firms, Companies, and Trusts

-

All business entities—partnerships, private/public limited companies, and trusts—require PAN for:

-

Corporate income-tax filings

-

TDS/TCS compliance on salaries, rent, professional fees, etc.

-

Indirect taxes (VAT, GST)

-

Banking and financial transactions

-

Non-Resident Indians (NRIs) & Foreign Entities

Non-Resident Indians (NRIs)

-

Property Transactions: Buying or selling real estate requires a PAN.

-

Investments: Mandatory for stocks, mutual funds, bonds, and other securities.

-

Bank Accounts: Needed for opening NRE, NRO, or FCNR accounts.

-

Income-Tax Filing: NRIs earning Indian-sourced income (rental, capital gains, business income) must file returns using PAN.

Foreign Companies

-

This requirement applies to foreign companies that either have a permanent establishment or generate income from Indian sources such as services, royalties, or contracts.

-

It guarantees adherence to withholding tax regulations and facilitates legitimate involvement in India’s financial sector.

Hidden Benefits of a PAN Card

While PAN is widely recognised for tax filing and high-value transactions, it offers several lesser-known advantages that streamline financial management and compliance:

Tax Compliance Made Simple

-

Accurate Tracking of TDS/TCS: Form 26AS, your single source of truth for tax credits, consolidates all tax deductions linked to your PAN.

-

Consolidated Tax Profile: Aggregates income from salaries, bank interest, and investments, simplifying ITR filing and reducing errors.

-

Time Savings: Minimises manual reconciliation and potential notices from the tax department.

Seamless High-Value Transactions

-

Bank Deposits & Withdrawals: Cash transactions over ₹50,000 require PAN to deter evasion and promote traceability.

-

Credit-Card Applications: e-KYC via PAN verifies identity and fetches credit history for swift approvals.

-

Property & Vehicle Registrations: PAN submission is mandatory for major asset transfers, ensuring market transparency.

-

Insurance Premiums: Policies above ₹1 lakh in premiums often require PAN to comply with anti-money-laundering norms.

Unlocking Investment Opportunities

-

Equity Markets & IPOs: PAN is mandatory for opening a Demat account and participating in primary and secondary markets.

-

Mutual Funds & Bonds: PAN-based e-KYC enables instant, paperless investment via SIPs and lump-sum routes.

-

Pro Tip: Pre-verified PAN allows you to start SIPs immediately, helping build wealth systematically.

Loan Processing & Credit-Score Enhancement

-

Faster Sanctions: Lenders access your credit bureau reports via PAN, expediting loan approvals.

-

Better Rates: A robust credit history translates to higher scores, unlocking lower interest rates and EMIs.

Digital & International Banking for NRIs

-

Repatriation of Funds: PAN-linked NRE/NRO accounts simplify cross-border fund transfers by streamlining tax deductions.

-

Global ITR Filing: NRIs can e-file Indian tax returns securely from anywhere, meeting Section 139A requirements without geographic constraints.

Step-by-Step Guide to Applying for a PAN Card

Online Application Process

1. Select the Correct Form

-

Form 49A: For Indian citizens (including NRIs) and entities incorporated in India.

-

Form 49AA: For foreign applicants (PIOs, OCIs, foreign entities).

2. Complete the Application

-

Please ensure that your personal, contact, and family details are entered accurately.

3. Upload Documents

-

Identity Proof: Aadhaar, passport, driving license, etc.

-

Address Proof: Utility bills, voter ID, passport, etc.

-

Photograph & Signature: Recent passport-size photos and scanned signature.

4. Payment & E-Signature

-

Fees: ~₹107 (domestic), ~₹1,017 (foreign dispatch).

-

E-sign: Via Aadhaar OTP or upload a signed PDF as per portal instructions.

5. Acknowledgment

-

Please download the e-receipt, which includes a 15-digit acknowledgement number for tracking.

Offline Application Process

-

Download & print Form 49A/49AA from the NSDL/Protean or UTIITSL websites.

-

Fill it out manually & attach photos as per the guidelines.

-

Submit documents at a PAN Facilitation Centre (PSA) along with the fee.

-

Please obtain an acknowledgement slip for status tracking.

Tracking & Corrections

-

Track Status: Use your acknowledgement number on the NSDL or UTIITSL portal.

-

Apply for Corrections: Complete the “Request for New PAN Card/Corrections” form, upload supporting documents, pay the correction fee, and submit.

Linking PAN with Aadhaar & Other IDs

Why, Link?

-

Legal Mandate: Section 139AA requires PAN–Aadhaar linkage; failure may render PAN inoperative.

-

Faster E-Filing: Pre-authenticated Aadhaar reduces manual verification delays.

-

Unified Identity: Ensures consistency of demographic details across government records.

How to Link

-

SMS: Send to or

UIDPAN <12-digit Aadhaar> <10-digit PAN>56767856161 -

Income Tax e-Filing Portal: Log in → Profile Settings → Link Aadhaar → Verify & Submit.

-

TIN Facilitation Centres: Submit Form 49A with Aadhaar details for linking.

Frequently Asked Questions

What is the main purpose of a PAN card?

It uniquely identifies taxpayers, simplifies TDS/TCS tracking, and is mandatory for high-value financial transactions.

Is a PAN card mandatory for every Indian citizen?

Yes—anyone earning taxable income or undertaking significant financial activities must obtain a PAN under Section 139A.

How do I apply for a PAN card online?

Fill out Form 49A on NSDL/UTIITSL’s portal, upload documents, pay the fee, and e-sign via Aadhaar OTP.

Can NRIs apply for a PAN card, and what documents are required?

NRIs use Form 49AA; documents include a passport copy, overseas address proof, and a recent photograph.

Could you please let me know the typical timeframe for receiving a PAN card?

Online applications typically receive acknowledgement within 10–15 business days.

Can a PAN card serve as an address?

Yes—if the address printed on the PAN matches your current residence.

What’s the difference between PAN and TAN?

PAN identifies individual and corporate taxpayers; TAN (Tax Deduction and Collection Account Number) is for entities deducting or collecting tax.

Conclusion

A PAN card is far more than a tax-filing requisite—it is a versatile key to India’s financial ecosystem. By understanding its hidden benefits—from streamlined transactions and credit advantages to NRI-friendly banking and investment ease—you position yourself for maximum economic flexibility. Apply for or update your PAN details today, link it with your Aadhaar, and unlock the full spectrum of privileges that make a PAN card indispensable for every Indian.