16 Budgeting Tips to Manage Your Money Better

A budget is simply a plan for your cash flow, but many people picture spreadsheets that steal all the fun from life. Stick with me and you will see that smart budgeting tips are not about restriction; they are about choice. With the right approach you can enjoy stress-free spending, faster debt payoff, and the thrill of reaching big financial goals months or even years sooner. In the next few minutes you will discover 16 budgeting tips used by top money coaches and real families alike. We will break down each idea in clear language, share step-by-step moves you can start tonight, and answer the internet’s most popular questions along the way. Grab a notebook or open your favourite notes app. By the end, you will have a practical spending plan built on common-sense budgeting tips, ready to guide every pay cheque toward the life you want.

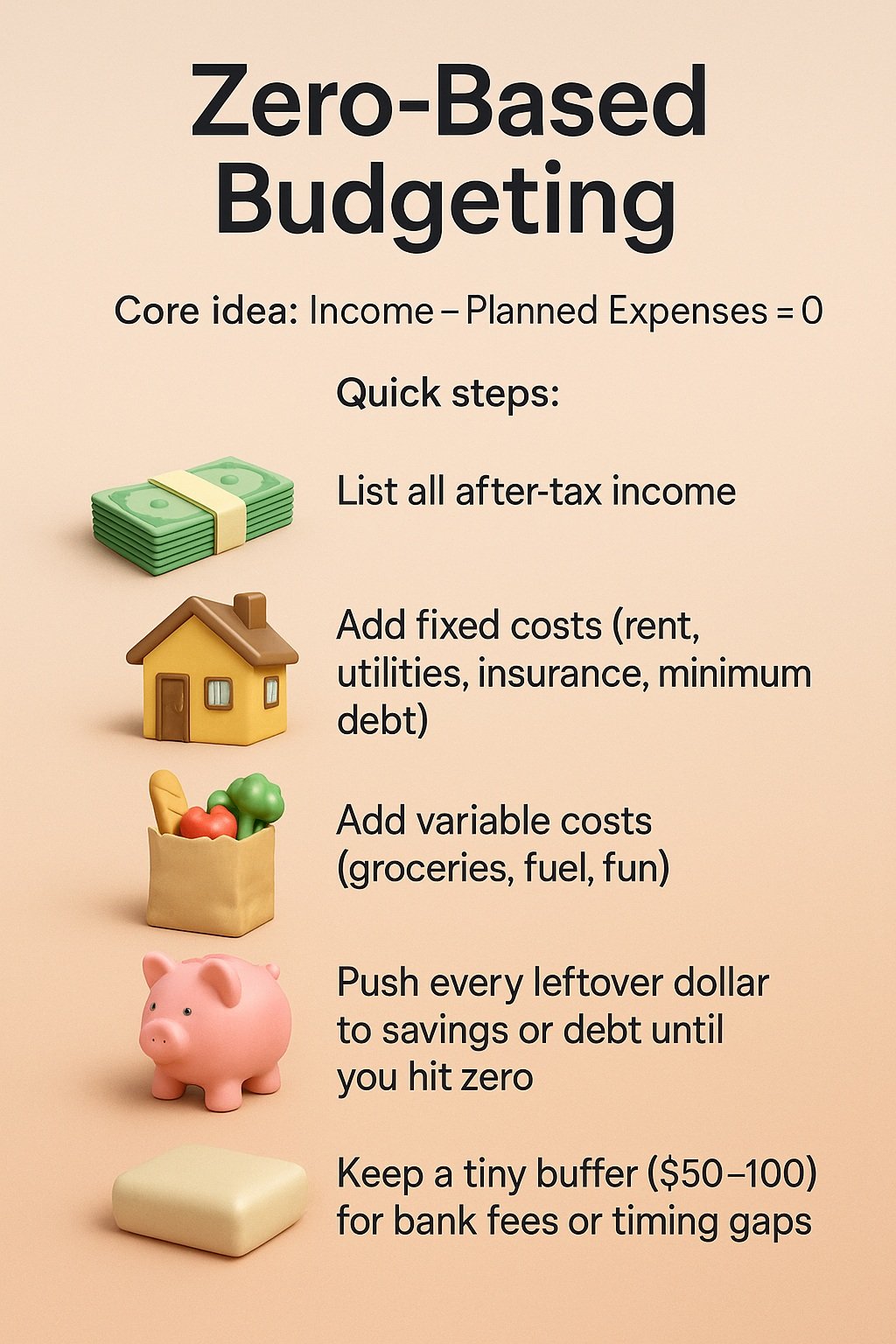

What Is Zero-Based Budgeting, and Why Start Here?

Zero-based budgeting gives every dollar a job before the month begins. Income minus planned expenses equals zero. That includes savings, investing, and debt payments. Starting with this framework keeps money from “escaping” into impulse buys.

Strategy Steps

-

Write down all after-tax income for the coming month.

-

List fixed costs: rent, utilities, insurance, and minimum debt payments.

-

Estimate variable items: groceries, fuel, and fun.

-

Allocate money to savings or debt goals until the math hits zero.

-

Keep a small buffer of 50-100 for surprise bank fees or timing gaps.

Using zero-based budgeting tips first sets a strong foundation for everything that follows.

How Do I Budget as a Team? (Couples or Accountability Partners)

Money arguments often trace back to unclear plans. When two people build the budget together, every win feels shared, and every setback becomes easier to solve.

Strategy Steps

-

Schedule a monthly money date on a calm evening.

-

Bring all numbers: income, bills, and card statements.

-

Agree on joint priorities like an emergency fund or vacation.

-

Use shared apps or a simple Google Sheet for transparency.

-

Celebrate progress with a low-cost treat such as takeout or a movie night.

Regular communication turns budgeting tips into shared life goals, not solo chores.

What Are the Four Walls, and How Do I Prioritise Essentials?

The four walls are food, utilities, shelter, and transportation. Cover these before anything else. When life feels chaotic, focusing on the walls keeps lights on and bellies full.

Strategy Steps

-

List the minimum cost of groceries, power, water, housing, and basic fuel.

-

Fund these first in your zero-based plan.

-

Delay wants subscriptions until walls are secure.

-

Build a one-month emergency fund to protect the walls long-term.

Prioritising essentials is one of the timeless budgeting tips that shields you from crisis debt.

Why Overestimate New Categories?

If you have never tracked an expense, you will underestimate it. Adding new categories stops you from dipping into savings to cover shortfalls.

Strategy Steps

-

Add a 10 percent cushion to groceries, dining out, and fuel for the first 90 days.

-

Compare planned versus actual spending weekly.

-

After three months, tighten numbers to realistic averages.

-

Redirect any leftover cushion to debt or savings.

This practical twist keeps your budgeting tips honest and flexible.

How Do I Adjust My Budget Each Month?

Life events such as birthdays, car repairs, or annual insurance renewals make a static plan obsolete. A rolling monthly review keeps your money map current.

Strategy Steps

-

On the last Sunday of each month, open next month’s calendar.

-

List irregular expenses: gifts, school fees, and license renewals.

-

Add sinking funds for these items into the budget.

-

Shift dollars from lower priority wants if needed.

Routine adjustments prevent good budgeting tips from getting stale.

Which Debt Payoff Method Works Fastest? (Snowball vs Avalanche)

The snowball method pays off debts from smallest balance to largest, gaining momentum. Avalanche targets the highest interest first, saving money over time. Choose the style that keeps you motivated.

Strategy Steps

-

List debts with balance, rate, and minimum payment.

-

Pick snowball if quick wins spark you; pick avalanche to reduce interest.

-

Pay minimums on all but target debt.

-

Throw every extra dollar at the target until it’s gone.

-

Roll that payment into the next debt.

Both methods pair well with the other budgeting tips to clear liabilities for good.

What Expenses Can I Cut Without Feeling Deprived?

Small leaks sink big ships. Identify low-value costs that add up but bring little joy.

Strategy Steps

-

Print the last two months of statements and highlight recurring charges.

-

Cancel or pause unused streaming, gym, or software subscriptions.

-

Swap name brands for generic ones on staples.

-

Negotiate internet or phone bills once a year.

-

Redirect savings to your highest goal so cuts feel worthwhile.

Smart trimming is one of the budgeting tips that frees cash without lifestyle shock.

Should I Automate Bill Payments?

Automation removes human error and late fees. It also shields willpower on heavy spending days.

Strategy Steps

-

Set fixed bills to auto-pay on or just after payday.

-

Move 10 percent to savings or investment automatically.

-

Turn on low balance alerts to avoid overdraft.

-

Review all auto payments weekly to stay aware.

Automation turns budgeting tips into a safety net more reliable than memory.

How Do Clear Goals Keep Me Motivated?

Vague aims kill discipline. Specific targets keep your brain engaged.

Strategy Steps

-

Write goals in SMART format: specific, measurable, achievable, relevant, and time-bound.

-

Post a visual tracker on the fridge or phone lock screen.

-

Break big goals into micro milestones, such as the first 500 saved.

-

Review progress at the end of each month and adjust.

Goal clarity powers every other set of budgeting tips on this list.

How Often Should I Check In with My Budget?

Frequent check-ins catch drift early and make corrections painless.

Strategy Steps

-

Daily: two-minute glance at account balances or app dashboard.

-

Weekly: fifteen-minute review of spending categories and receipts.

-

Monthly: full rebuild for the next period.

-

Quarterly: compare year-to-date progress against big goals.

Regular contact keeps budgeting tips alive instead of forgotten.

Why Add a Miscellaneous Line?

Even the best planner misses random costs: school pictures, office collections, and pet meds.

Strategy Steps

-

Allocate 2-4 percent of income to a category called Misc.

-

Log any surprise expense there.

-

If an item repeats, create its own line next month.

-

Roll unused misc. cash into savings every quarter.

This buffer is the duct tape of budgeting tips, sealing cracks fast.

Is It Time to Ditch Credit Cards?

Credit cards can be tools or traps. The answer depends on habits and goals.

Strategy Steps

-

Calculate total interest paid in the last year.

-

Test a 90-day cash or debit challenge.

-

If balances stay at zero, keep one card for rewards and pay in full each week.

-

If balances grow, cut cards and shop with cash until habits reset.

Honest assessment is among the hardest but most rewarding budgeting tips.

Can Cash Envelopes or Digital Wallet Buckets Curb Overspending?

Physical and digital envelopes create hard limits. They make spending visible.

Strategy Steps

-

Choose three trouble categories like dining, clothes, and hobbies.

-

Withdraw or transfer exact amounts for each envelope every payday.

-

Spend only from that pool. Stop when empty.

-

Review envelopes weekly and tweak amounts next cycle.

Envelope systems remain classic budgeting tips because they balance freedom and restraint.

How Does Contentment Beat Comparison Spending?

Marketing shows highlight reels. Real life costs less glory and more grit. Contentment keeps money where it serves you.

Strategy Steps

-

Unfollow social media accounts that trigger envy spending.

-

Keep a gratitude journal to note daily wins.

-

Practice a 24-hour pause on non-essential purchases.

-

Swap costly outings for potlucks or game nights once a month.

Mindful choices enhance the emotional side of these budgeting tips.

Why Give Yourself Grace?

Perfectionism kills progress. Grace turns mistakes into lessons.

Strategy Steps

-

Expect a three-month learning curve for any new budget.

-

When overspending happens, adjust numbers rather than quit.

-

Celebrate each small victory, such as paying one bill early.

-

Share wins and slips with a trusted friend to stay grounded.

Self-kindness is a hidden success factor among budgeting tips.

Which Budgeting App Fits My Style?

Apps can simplify math and provide real-time insights, but one size never fits all.

Strategy Steps

-

If you love zero-based budgeting, test EveryDollar or You Need a Budget.

-

For envelope style, look at Goodbudget or Fudget.

-

Want AI spending insights? Try Monarch or Copilot.

-

Use free trials for 30 days and keep the app that feels intuitive.

-

Review app fees yearly to ensure value.

The right tool turns great budgeting tips into daily habits with less effort.

FAQ

| Question | Brief Answer |

|---|---|

| What is the 50/30/20 budget rule? | It splits after-tax income into 50 percent needs, 30 percent wants, and 20 percent savings or debt payoff. |

| How do I start budgeting if I have a low income? | Begin with zero-based budgeting, cover four walls first, and automate tiny transfers of five or ten dollars to savings. |

| What is the difference between zero-based and envelope budgeting? | Zero-based plans every dollar on paper, while envelope (cash or digital) controls spending at the point of purchase. |

| Which budgeting app is best in 2025? | EveryDollar excels for zero-based fans, YNAB for envelope lovers, and Monarch for AI-powered insights. |

| How can I stay motivated to stick to a budget? | Use visual trackers, celebrate quick wins with the debt snowball, and review goals monthly. |

| What is the debt snowball method? | Pay off debts from smallest balance upward, rolling freed payments into the next balance for momentum. |