Planning your financial future doesn’t have to be a challenging task. With goal-based planning, a monthly savings calculator, and a simple FIRE (Financial Independence, Retire Early) calculator, you’ll know exactly how much to set aside each month to fund that dream house, car, or early retirement. By the end of this article, you’ll have a clear roadmap: the exact monthly savings target for each dream, plus which free calculators and proven tactics will get you there.

What Is Goal-Based Planning?

Consider goal-based planning as your financial navigation system. Instead of wandering through each month hoping you’ll somehow hit your target, you set a clear destination—whether that’s buying a $300,000 home, getting a $30,000 car, or building a $1.5 million nest egg for early retirement—and then work backward to figure out exactly how much to save each month. Use a monthly savings calculator to break down the large amount into smaller deposits, and if you’re striving for FIRE (Financial Independence, Retire Early), a FIRE calculator assists you in determining the duration of your savings under a safe withdrawal rate. By defining your goals this way, you trade uncertainty for confidence, and every dollar you tuck away feels purposeful.

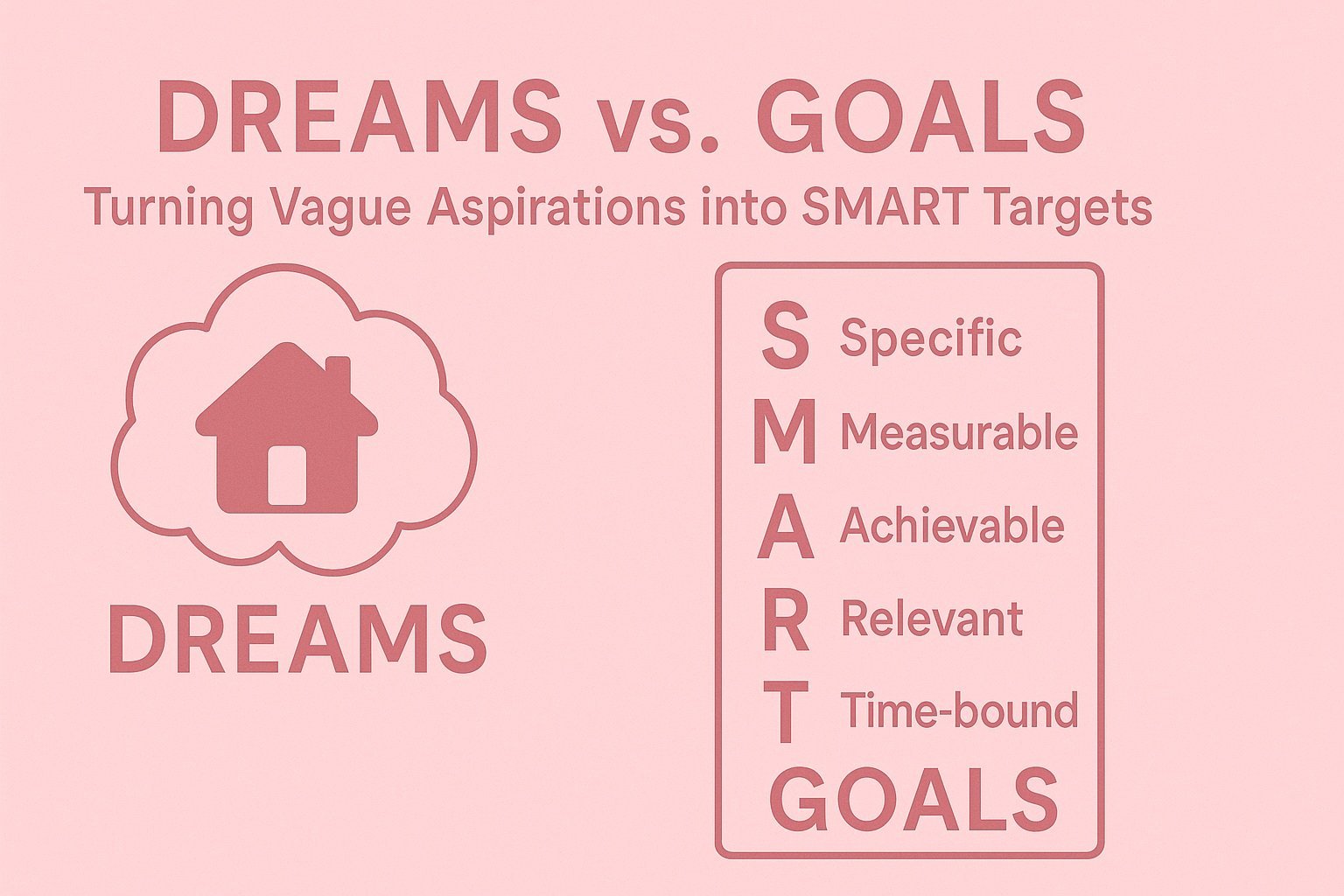

Dreams vs. Goals: turning vague aspirations into SMART targets

A dream is a wish without a plan. A goal adds clarity. Here’s how to turn your vague “someday” into a SMART target:

-

Specific: Name the amount and what it’s for.

-

Measurable: Attach a number—$300,000, $30,000, or $1.5 million.

-

Achievable: Make sure the monthly deposit fits your budget.

-

Relevant: Align it with what matters most—home ownership, a new car, or financial freedom.

-

Time-bound: Select a specific completion period, such as 10 years, 5 years, or 25 years.

Once you transform your aspiration into a concrete plan, such as “I will save $2,000 per month for 10 years to afford a $300,000 house”, it becomes a tangible goal. It’s a plan you can act on with your monthly savings calculator.

Why Monthly Numbers Matter: the psychology of smaller, trackable commitments

Breaking a big goal into monthly chunks plays right into human psychology. Small, consistent wins build momentum and keep motivation high. When you see “$500 saved this month toward my car” or watch your progress bar inch forward on a savings app, you get a little dopamine hit that makes you want to keep going.

Tiny, trackable commitments also reduce overwhelm. Facing a $1.5 million retirement target can feel paralysing; tackling $1,500 a month feels doable. And because you’re automating those deposits—treating them like any monthly bill—you’re far less likely to skip a payment. Over time, those small steps add up to major financial milestones without ever feeling like you’re denying yourself today.

6-Step Framework: Convert Any Dream Into a Monthly Target

Quantify the Dream (price your house, car, FIRE number)

First, give your dream a price tag. Head online or call local dealerships to find the average cost of your ideal home or car. If you’re pursuing FIRE, estimate your target nest egg by multiplying your desired annual expenses by 25 (a common guideline for a 4 percent safe withdrawal rate). Having a concrete number—whether it’s ₹3,00,00,000 for a home, $30,000 for a car, or $1,500,000 for early retirement—sets the stage for every step that follows.

Set the Time Horizon (years until purchase/retirement)

Next, choose a realistic countdown. Maybe you want to move into that house in ten years, drive your new car in five, or retire in twenty-five. Your time horizon determines how many months you have to save. Ten years gives you 120 months, five years gives you 60, and so on. The longer your horizon, the smaller your monthly target—but be careful not to stretch it so far that you lose motivation.

Adjust for Inflation & Taxes

A rupee today won’t buy as much in the future. Factor in average inflation—say 3 percent per year—by increasing your goal amount accordingly. If you need $300,000 in ten years and inflation averages 3 percent, you actually need about $403,000 in nominal terms. Please keep in mind taxes on investment gains; if you expect a capital gains tax of 15 percent, increase your savings buffer so that after taxes you still hit your target.

Run a Monthly Savings Calculator (derives rupee/dollar amount)

Please enter your adjusted goal, time horizon, and expected annual return into a monthly savings calculator. Enter your future goal amount, the total number of months, and a conservative interest rate—3 to 5 percent for most savings or bond-heavy portfolios. The calculator applies the future value of an annuity formula to tell you exactly how much to save each month. Suddenly, your big dream becomes something like ₹75,000 per month or $500 per month.

Stress-Test With a FIRE Retirement Calculator (rate-of-return, safe-withdrawal)

If your goal is early retirement, use a FIRE retirement calculator to validate your plan. Enter your projected nest egg, expected annual return (for example 6 percent from a balanced portfolio), and a safe withdrawal rate (commonly 4 percent). The tool simulates whether your savings can sustain your lifestyle for 30 years or more. If it flags a shortfall, you can increase your monthly savings or reconsider your withdrawal assumptions before you get too far down the road.

Automate, Track & Rebalance every six months

Finally, automate your plan. Please arrange for an auto-transfer to ensure your monthly savings deposit reaches the goal account on payday. Use a budgeting app or spreadsheet to track progress and celebrate small wins each month. Every six months, revisit your allocations and rebalance your investments—shift gains back to your target asset mix, factor in any salary increases, and adjust for changes in inflation or tax rules. This method keeps your goal-based planning on track without adding stress to your daily life.

Strategy Boosters for Faster Progress

Increase Savings Rate (income hikes, expense cuts)

If you want to accelerate your savings plan, focus on two levers: earning more and spending less. On the income side, consider asking for a raise, picking up freelance work on weekends, or monetising a hobby. Every extra rupee you earn can go straight into your goal account. On the expense side, please review your subscriptions and consider discontinuing those you seldom use. Cooking at home instead of ordering in, shopping your pantry before restocking, or switching to a lower-cost phone plan can free up dozens or even hundreds of rupees each month. When you boost your savings rate, those monthly targets from your calculator suddenly feel much more achievable.

Invest for Higher Real Returns (index funds vs. fixed income)

Putting all your cash under the mattress protects it from market swings but won’t keep pace with inflation. By contrast, low-cost index funds have historically delivered real returns above inflation over the long run. Fixed-income options like bonds or high-yield savings offer stability and predictable interest but tend to lag behind equities over decades. A balanced mix—say 60 percent in a broad market index fund and 40 percent in fixed income—can smooth volatility while still growing your nest egg faster than cash alone. Please consider adjusting the split as you approach your goal to secure gains while minimising the risk to your principal.

Lower the Goal Cost (house-hacking, buying used)

Occasionally the fastest way to reach a target is to shrink it. If you’re saving for a home, consider house-hacking by renting out a spare room or duplex unit to offset your mortgage. For a vehicle, look at certified pre-owned models that come with warranties but cost significantly less than brand new. Even in a FIRE plan, trimming your expected annual expenses by downsizing living space or embracing a minimalist lifestyle can cut your required nest egg. Smaller goals mean lower monthly deposits—and faster wins that keep you motivated.

Stack & Sequence Multiple Goals without over-stretching cash flow

Juggling a down payment, a car fund, and early retirement contributions can get overwhelming. Instead, sequence them. Start by tackling the smallest or most urgent goal—your sinking-fund spreadsheet makes this trackable—while maintaining baseline contributions to longer-term dreams with your monthly savings calculator. After funding the first goal, transfer its contribution to the subsequent one. This “rollover” strategy keeps your total savings rate constant while giving you regular victories. If you ever need to reprioritise, you can adjust your calculator’s inputs and rebalance your allocations without derailing the entire plan.

Common Pitfalls & How to Avoid Them

Ignoring Inflation Shocks

The movement of inflation is not linear. One year, it might hover around 3 percent, the next, it could spike to 7 percent. If you set your goal-based planning targets and never revisit them, a sudden jump in living expenses can leave you short. Your monthly savings calculator might tell you to save ₹50,000 per month for your dream home, but if inflation erodes purchasing power faster than expected, that amount won’t buy the same house in ten years.

To avoid this trap, revisit your goal figures at least once a year. Plug updated inflation data into your monthly savings calculator and adjust your goal amount. If your FIRE calculator assumed a 4 percent withdrawal rate based on lower inflation, run new scenarios with higher cost assumptions. Treat inflation check-ins as part of your rebalance routine so you always know you’re on track.

Lifestyle Creep After Salary Raises

Nothing feels better than a bigger pay cheque. Yet without a plan, extra income often flows directly into upgraded subscriptions, dining out, or high-end gadgets. Before long, your cost of living ratchets up, and your earlier goal-based planning becomes harder to sustain. If you promised yourself you’d save 20 percent of each raise but then silently let that figure slide to 5 percent, your FIRE number or house down-payment timeline will stretch out significantly.

The solution is simple: automate increase. When your salary lands, immediately route a fixed percentage—ideally at least half of the raise—into your goal accounts. Please update your monthly savings calculator to reflect the new baseline. Seeing that fresh chunk of savings reinforce your progress keeps lifestyle creep in check and accelerates your timeline.

Failure to Rebalance Investments

A balanced portfolio drifts over time. Stocks can surge, bonds can lag, and suddenly you’re taking on more risk—or not enough growth—to meet your goals. If you ignore portfolio drift, the rate of return you plugged into your FIRE retirement calculator becomes outdated, and your projections could mislead you.

Please ensure that rebalancing is conducted every six months without exception. Whether you use a robo-advisor, your broker’s automated tool, or a simple spreadsheet, sell or buy just enough assets to restore your target mix. Pair this with your routine goal-based planning review: run the numbers through your monthly savings calculator after each rebalance to confirm that your adjusted portfolio still aligns with your timeline. That way your dream stays firmly within reach.

Real-Life Case Studies

₹50 Lakh Starter Home in 7 Years

Meet Aarav, a 28-year-old software engineer who dreamed of owning his first home without relying on loans. He priced his starter home at ₹50 lakh and set a seven-year horizon. After adjusting for 4 percent annual inflation, his goal rose to roughly ₹65 lakh in nominal terms. Using a monthly savings calculator with a 5 percent expected return, he discovered he needed to save about ₹60,000 each month.

He automated that deposit the day his paycheque hit his bank account. To stay motivated, he tracked progress in his sinking-fund spreadsheet, which showed a bright green bar inching forward each month. Every six months, he ran his FIRE retirement calculator just to stress-test his broader portfolio—making sure he stayed diversified in a 60/40 stocks-to-bonds mix—and rebalanced as needed. By year four, a bonus from work allowed him to shave off two years from his timeline. Today, at 35, Aarav has the keys in hand and zero home loan debt.

| Metric | Value |

|---|---|

| Adjusted Goal (inflation-adjusted) | ₹65,00,000 |

| Time Horizon | 7 years (84 months) |

| Monthly Savings Needed | ₹60,000 |

| Portfolio Mix | 60% Index Funds / 40% Fixed Income |

FIRE at 45 With ₹6 Crore Corpus

Priya, a 30-year-old marketing manager, targeted financial independence by age 45 with a ₹6 crore corpus. She calculated her annual expenses at ₹12 lakh and applied the 25× rule to arrive at her nest egg. With a 15-year horizon, she used the monthly savings calculator, assuming a conservative 6 percent annual return. The tool told her to save about ₹1.75 lakh per month.

To hit this ambitious number, she increased her savings rate each time she got a raise, automatically routing half of any salary bump into her FIRE account. She also invested primarily in low-cost index funds, topping off with high-yield bonds for stability. Every quarter she ran the FIRE retirement calculator, tweaking her safe-withdrawal assumptions as her portfolio grew. By automating contributions and tracking everything in her sinking-fund spreadsheet, Priya stayed on track—turning what once felt impossible into a clear, actionable plan.

₹8 Lakh Car in 3 Years Debt-Free

Raj wanted a reliable car without financing. He settled on an ₹8 lakh model and gave himself three years to save. Ignoring complex inflation adjustments for a shorter-term goal, he plugged ₹8 lakh and 36 months into his monthly savings calculator at zero assumed interest. The result: about ₹22,250 per month.

Raj started small by cutting nonessential subscriptions and cooking at home three nights a week. That freed up an extra ₹5,000, which he funnelled into his car sinking fund spreadsheet. He also did weekend freelancing, boosting his savings rate without touching his base salary. To keep things simple, he parked this money in a liquid high-yield account rather than investing. Three years later, he marched into the dealership with cash in hand and zero debt hanging over him.

Goal-Based Planning FAQ

What’s the difference between goal-based planning and traditional budgeting?

Traditional budgeting focuses on categorising income and expenses each month, asking, “How much can I allocate to rent, groceries, and entertainment?” Goal-based planning reverses this approach by beginning with your aspirations, such as purchasing a home or retiring early, and calculating the precise monthly savings required. Instead of simply tracking where your money goes, goal-based planning gives each rupee a purpose tied to a specific SMART target, complete with a timeline and progress checkpoints.

How do I pick the best monthly savings calculator?

Look for a calculator that lets you enter your goal amount, time horizon, and expected annual return in a few clicks. The ideal tool will:

-

Offer adjustable interest-rate assumptions so you can model conservative or aggressive scenarios

-

Display results in clear charts or tables to visualize your savings path

-

Allow downloads or embeds so you can customize the sheet with your own branding

Templates such as our downloadable Google Sheets Monthly Savings Calculator fulfil all these requirements, facilitating the customisation of inputs and the sharing of the live embed on your blog or intranet.

How much should I save each month to reach FIRE?

First, estimate your annual expenses in retirement and multiply by 25 to get your FIRE target corpus. For example, if you need ₹12 lakh per year, your nest egg target is ₹3 crore. Next, choose your horizon—say, 15 years—and assume a realistic annual return, perhaps 6 percent from a balanced index fund portfolio. Please input these numbers into a monthly savings calculator to determine your precise monthly contribution. In our earlier case study, we found that saving for a corpus of ₹6 crore over 15 years at an annual return of 6 percent required approximately ₹1.75 lakh per month.

How often should I revisit my plan?

Life changes, market swings, and inflation spikes can all affect your roadmap. Check in with your goal-based plan at least once a year to update inflation and tax assumptions, then run your monthly savings and FIRE calculators again. Every six months, rebalance your investments back to your target mix and adjust any automated transfers based on raises or bonus income. These regular reviews ensure your goals stay within reach without becoming outdated.

Can I pursue multiple financial goals at once?

Absolutely. Use a stacking and sequencing approach: maintain a baseline contribution to each long-term dream, then focus extra cash flow on one short-term goal at a time—your sinking-fund spreadsheet makes this clear. Once you’ve funded the first target, roll that contribution into the next goal while keeping automation intact. This method prevents cash-flow overwhelm and delivers regular wins that fuel momentum toward every dream you’re chasing.