Lifestyle inflation So-called lifestyle creep is the gradual tendency to increase spending as income rises. Instead of allocating raises, bonuses, or extra earnings toward savings and investments, many individuals subconsciously upgrade their expenses: a pricier smartphone, more expensive dining experiences, or an upscale subscription service. Over time, even modest raises can slip away, leaving monthly budgets tight and savings stagnant.

From 2022 to 2023, household spending jumped 5.9% across all income levels, yet barely half of adults maintained a three-month emergency fund (Investopedia). In other words, while paycheques grew, so did spending habits, and most people failed to use that extra income as a financial buffer. When income increases but spending adjusts in lockstep, it becomes nearly impossible to break free from living pay cheque to pay cheque, even if your salary doubles.

Failing to recognize lifestyle inflation can have serious consequences. Without a dedicated emergency reserve, unexpected medical bills, car repairs, or job loss can force families to rely on credit cards or high-interest loans. Over time, unchecked spending can erode long-term goals like homeownership, retirement planning, or pursuing further education. Worse, if every rupee earned is spent, there is no money left to invest in higher-return assets, ultimately slowing wealth accumulation.

Yet the good news is that lifestyle inflation is neither inevitable nor irreversible. By identifying the warning signs early and adopting targeted strategies, it is possible to ensure that each raise, bonus, or side-income stream actually contributes to building wealth, rather than merely funding a slightly larger lifestyle. Research shows that households that automate savings and adhere to clear budgeting frameworks are significantly more likely to grow their net worth over time, sometimes by as much as 20–30% annually, compared to peers who let lifestyle creep dictate their spending.

This guide unpacks eight research-backed tactics, ranging from automating savings (“pay yourself first”) to building a bulletproof emergency fund, so each rupee you earn translates into long-term financial freedom, and not just a marginal upgrade in monthly expenses. By understanding how to detect early warning signs of lifestyle inflation, using practical tools and apps to stay on track, and following a concise five-minute action plan, you can turn pay raises into milestones on the path to true financial independence rather than triggers for increased spending.

What Is Lifestyle Inflation?

Snippet-Ready Answer

Lifestyle inflation happens when spending increases in lockstep with salary growth, so the gap between income and expenses never widens. Over time, luxuries feel essential, savings stagnate, and wealth-building stalls.

| Year | Income Growth | Spending Growth | Net-Worth Growth |

|---|---|---|---|

| Year 1 | ₹6 L → ₹7 L (▲ 17 %) | ₹4 L → ₹5 L (▲ 25 %) | Flat |

| Year 3 | ₹7 L → ₹9 L (▲ 29 %) | ₹5 L → ₹6.5 L (▲ 30 %) | Minimal |

| Year 5 | ₹9 L → ₹12 L (▲ 33 %) | ₹6.5 L → ₹9 L (▲ 38 %) | Drags |

Income growth ≠ wealth growth. The hedonic treadmill keeps resetting pleasure baselines, while the Diderot effect turns one upgrade (a new sofa) into a chain reaction (new curtains, rug, and décor), compounding overspending.

In practical terms, as salary climbs from ₹6 L to ₹12 L over five years, corresponding spending inflates from ₹4 L to ₹9 L, leaving little to no room for net worth expansion. This phenomenon is often fuelled by the hedonic treadmill, a psychological pattern where each purchased upgrade temporarily boosts happiness but soon becomes the new baseline for satisfaction. As a result, individuals constantly chase greater comforts without ever feeling materially “rich” enough.

Compounding the issue is the Diderot effect, where one purchase triggers a cascade of additional upgrades. For example, buying a designer sofa might inspire matching décor, new curtains, or a lavish coffee table, each incremental expense adding to the cycle of consumption. Over time, these subtle upgrades accumulate, transforming modest raises into fleeting luxuries rather than long-term wealth accelerators.

By recognising these cognitive traps – hedonic adaptation and the Diderot effect – readers can pinpoint why extra income tends to vanish into lifestyle costs. Understanding that higher income doesn’t automatically translate to greater net worth is the first step toward interrupting this cycle and redirecting funds into savings, investments, and true financial growth.

Why Lifestyle Creep Hurts Your Future Wealth

When lifestyle creep takes hold, a lower savings rate directly translates to a smaller compounding snowball over time. Imagine setting aside ₹10,000 each month in a Systematic Investment Plan (SIP) during your 20s. If you skip that SIP due to increasing expenses, you potentially forfeit over ₹2 crore by retirement because you miss out on decades of compounded returns. Even small lapses in discipline early on can cascade into massive shortfalls later, as the exponential nature of compounding rewards consistent, long-term investments.

Emergency-fund gaps created by lifestyle creep leave you one job loss away from high-interest debt. Without a three- to six-month buffer, any unexpected expense, be it medical, job transition, or urgent home repair, forces reliance on credit cards or personal loans carrying interest rates upward of 18–24%. High-interest debt not only erodes principal capital but also saddles you with monthly interest obligations that further reduce your ability to rebuild an emergency fund. Over time, this vicious cycle of debt repayment stifles future wealth accumulation.

Status financing flashy upgrades adds a significant interest drag that undermines long-term financial goals. When you finance luxury items like premium gadgets, designer furniture, or a high-end vehicle, you may feel immediate gratification. However, most consumer financing comes with double-digit interest rates that can negate investment returns. For instance, if you take a personal loan at 15% APR to buy a luxury watch, you need an equivalent investment return just to break even. That “interest drag” syphons funds away from wealth-building avenues, making it increasingly difficult to catch up.

Psychological stress and comparison culture intensify the impact of lifestyle creep. As social feeds constantly display curated highlight reels, the fear of missing out (FOMO) spikes chronic overspending. Every scroll through friends’ vacation photos or colleagues’ luxury car purchases triggers subtle pressure to “keep up”, prompting unnecessary upgrades. Research shows that this pressure amplifies anxiety levels, which can lead to impulsive financial decisions such as dining at expensive restaurants more frequently or subscribing to premium services you don’t fully use. These reactive purchases chip away at your disposable income and derail long-term wealth strategies.

Finally, the opportunity cost of lifestyle creep is enormous: every inflated rupee spent today is a rupee that cannot generate passive income tomorrow. Money diverted to cover incremental lifestyle expenses like upgrading to a higher-rent apartment, dining out weekly, or purchasing brand-name goods could otherwise be invested in dividend-yielding equities, rental properties, or debt instruments. Over a decade, even reallocating ₹5,000 per month from discretionary spending to an equity mutual fund at a 10% annual return could yield more than ₹12 lakh. By contrast, that same ₹5,000 spent on status upgrades yields zero returns and leaves you further behind your retirement and financial independence targets.

In essence, lifestyle creep quietly sabotages your future wealth by shrinking your compounding engine, exposing you to high-interest liabilities, adding interest drag through financed purchases, increasing psychological stress and impulsive spending, and creating substantial opportunity costs. Recognising these pitfalls is the crucial first step toward redirecting more of your income into sustainable, wealth-creating channels.

8 Proven Ways to Beat the “More Money, More Spending” Trap”

Pay Yourself First (Automate Savings)

When a salary increase or bonus lands in your account, the easiest way to fight lifestyle inflation is to funnel those extra funds directly into savings or investments before you ever see them in your checking balance. By setting up an automatic transfer of a fixed percentage of each pay cheque into a high-yield savings account or a Systematic Investment Plan (SIP), you eliminate the temptation to spend. In fact, as Forbes notes, building a habit of saving often beats relying on willpower alone.

To put this into action, consider the following windfall allocation model:

| Allocation Category | Percentage |

|---|---|

| Investments (Long-Term) | 50% |

| Financial Goals (Short-Term or Medium-Term) | 30% |

| Guilt-Free Spending | 20% |

For instance, if you receive a ₹1 lakh bonus:

-

Allocate ₹50,000 to long-term investments (equities, mutual funds, or a high-yield account).

-

Direct ₹30,000 toward specific goals like paying down debt or boosting your emergency fund.

-

Reserve ₹20,000 for discretionary spending (dining out, a weekend getaway, or a small gadget upgrade) so you still enjoy some of the reward without derailing your savings plan.

How-to Snippet (120 char)

“Set an auto-transfer for 20% of every pay cheque within 24 hrs of deposit.”

This automatic, rules-based approach ensures that every rupee you earn immediately contributes to wealth-building rather than being syphoned off by increasing lifestyle costs.

Adopt a Values-Based or 50-30-20 Budget

Aligning your spending habits with personal values helps you resist unnecessary upgrades. Rather than simply giving every extra rupee to a new purchase, question each expense against what truly matters, whether that’s travel, education, family experiences, or early retirement. A 50-30-20 budgeting framework can serve as a straightforward starting point, especially when you receive a raise:

-

50% Needs: Essentials like rent, utilities, groceries, and insurance.

-

30% Wants: Dining out, streaming subscriptions, and vacation expenses that add enjoyment.

-

20% Goals: Debt repayment, emergency fund deposits, and long-term investments.

After every raise, reapply the 50-30-20 split. If your monthly income moves from ₹60,000 to ₹75,000:

-

₹37,500 goes to essential living costs.

-

₹22,500 is earmarked for discretionary “wants”.

-

₹15,000 is automatically allocated to financial goals.

Zero-based budgeting apps such as You Need A Budget (YNAB) force you to assign every rupee a job, so nothing drifts into lifestyle creep unintentionally. By prioritising expenses that reflect your core values and rigidly funding your savings first, you guard against letting higher income inflate your standard of living.

Build a Bulletproof Emergency Fund

Before entertaining any lifestyle upgrades, aim to establish an emergency fund equal to 3–6 months of living expenses. Without this financial cushion, even a small setback, like a medical bill or car repair, can force you to rely on high-interest credit cards or personal loans. As NerdWallet warns, lifestyle creep can derail retirement faster than market downturns if you aren’t prepared with liquid assets.

Key Steps to Build Your Fund:

-

Separate Account: Keep your emergency fund in a dedicated savings vehicle, ideally a liquid debt fund or a sweep Fixed Deposit (FD) that yields 4–6% per annum.

-

Monthly Target: Calculate total monthly expenses (rent, utilities, groceries, loan EMIs). Multiply by 3 to 6, then divide into equal monthly contributions until the goal is met.

-

Pause Upgrades: Resist upgrading your home, car, or other big-ticket items until the emergency fund target is secured.

By locking down a reliable cash buffer before increasing any lifestyle expenses, you ensure that an unexpected event won’t force you into debt. Only once this fund is fully in place should you consider reallocating discretionary income toward lifestyle improvements.

Freeze Lifestyle Upgrades Until Targets Are Met

Upgrading to a pricier apartment, a newer car, or a premium gadget can be tempting once income rises, but committing to costly changes too early often leads to regret. Instead, set clear financial milestones and only allow upgrades once you’ve hit predetermined net worth thresholds.

-

Threshold Approach: For example, don’t move to a higher-rent flat until your net worth surpasses ₹X lakh (including investments, savings, and any real estate equity).

-

Progress Milestones: When you’ve funded 80% of that net worth goal, treat yourself to a small, planned thing like a weekend getaway or a modest gadget while keeping major changes on hold.

-

Visual Tracker: Using a simple Sankey chart in tools like Notion or Google Sheets makes progress tangible. Map inflows (income) and outflows (expenses) alongside fund allocations, and update it monthly to visualise how close you are to your upgrade milestone.

By connecting lifestyle upgrades directly to quantifiable achievements, you avoid drifting into bigger expenses before you’re financially ready. This disciplined freeze prevents an unchecked increase in fixed costs that can weigh down your long-term wealth trajectory.

Use the 48-Hour (or 30-Day) Rule for Purchases

Impulse buys often fuel lifestyle inflation; one click can lead to a cascade of overspending. The solution: introduce a mandatory waiting period for non-essential purchases.

-

48-Hour Rule: For most items under ₹5,000 (clothes, small electronics, home décor), add the product to your online cart or wishlist and wait 48 hours before committing.

-

30-Day Rule for Big-Ticket Items: For more expensive purchases (laptops, furniture, premium smartphones), impose a 30-day cooling-off period. After 30 days, reassess whether the item still holds its value or if the initial desire has faded.

-

Wishlist Filter: During the waiting period, many items lose their allure. Deleting an item from the cart after the cooling-off window saves both money and needless clutter.

-

Browser Plug-ins: Tools like Honey or CamelCamelCamel can notify you of price drops on essentials, helping you buy at a lower rate rather than impulsively at full price.

By delaying gratification and creating friction in the buying process, you neutralise impulse spending and ensure that each purchase truly aligns with your long-term goals.

Audit & Trim Recurring Expenses Quarterly

Subscription creep silently drains your bank account if you’re not vigilant. Monthly charges – gym dues, OTT platforms, cloud storage, or software-as-a-service – can accumulate into hefty sums that leave little room for new savings.

Quarterly Audit Checklist:

-

List All Recurring Subscriptions: Note down each subscription fee, billing date, and purpose.

-

Evaluate Usage vs Cost: If you haven’t used a service in two months, either cancel or downgrade to a cheaper plan.

-

Negotiate Better Rates: Reach out to customer service. Often, you can secure promotional or loyalty rates that reduce fees by 10–20%.

-

Bundling Tactic: Combine telecom, broadband, and OTT subscriptions into a single bundle. Bundling typically cuts costs by 20–40% compared to standalone plans.

Conducting a thorough review every quarter prevents stealthy expenses from eating into your discretionary income. By trimming or renegotiating unwanted or underutilised subscriptions, you free up rupees that can be rerouted to high-priority savings and investment buckets.

Schedule Quarterly “Money Dates”

Staying on top of finances requires intentional check-ins. Block 60 minutes in your calendar every quarter for a dedicated “money date” to review and adjust your financial plan.

Money Date Agenda:

-

Net Worth Review: Update your spreadsheet or Notion template to reflect changes in investments, savings, and liabilities.

-

Goal Assessment: Check progress toward your short-term and long-term goals (e.g., emergency fund, down payment, retirement corpus).

-

Spending Analysis: Compare quarterly spending against your budget. Identify any categories where lifestyle creep started to slip in.

-

Automated Alerts: Enable bank SMS or app notifications for when monthly spending in any category exceeds 10% over the average of the previous three months. This early warning helps you course-correct before overspending becomes habitual.

You can do these reviews solo or with a partnershared Google Sheets or collaborative Notion pages bring transparency and accountability. Regular money dates make financial adjustments proactive rather than reactive, keeping lifestyle inflation firmly in check.

Create Accountability & Celebrate Wins Frugally

Forming an accountability loop exponentially increases your chances of sticking to a disciplined savings plan. A “money buddy” or a small community of like-minded peers can provide motivation, share insights, and apply gentle peer pressure to help you stay on track.

-

Money Buddy: Pair up with a friend or family member who has similar financial goals. Share monthly updates, challenges, and successes over a brief call or group chat.

-

Online Communities: Join finance-focused forums or WhatsApp groups where members discuss budgeting hacks, investment strategies, and small wins. Publicly committing to a goal, such as saving ₹10,000 each month, raises the stakes and strengthens resolve.

-

Frugal Celebrations: Reward yourself when you hit milestones but keep costs low. For under ₹1,000, treat yourself to a picnic in the park, a day-long hike, or a DIY spa day at home. These modest celebrations reinforce positive behaviour without undoing your progress.

-

Raise Rule of Thumb: After each salary bump, follow a mnemonic “Save 50% | Spend 30% | Invest 20%” and post it on your fridge or workspace. Having a visible reminder ensures you split raises in a way that throttles lifestyle creep and bolsters your balance sheet.

By weaving accountability into your financial routine and marking progress with cost-effective rewards, you transform saving from a chore into a shared journey and keep lifestyle inflation from hijacking your future wealth.

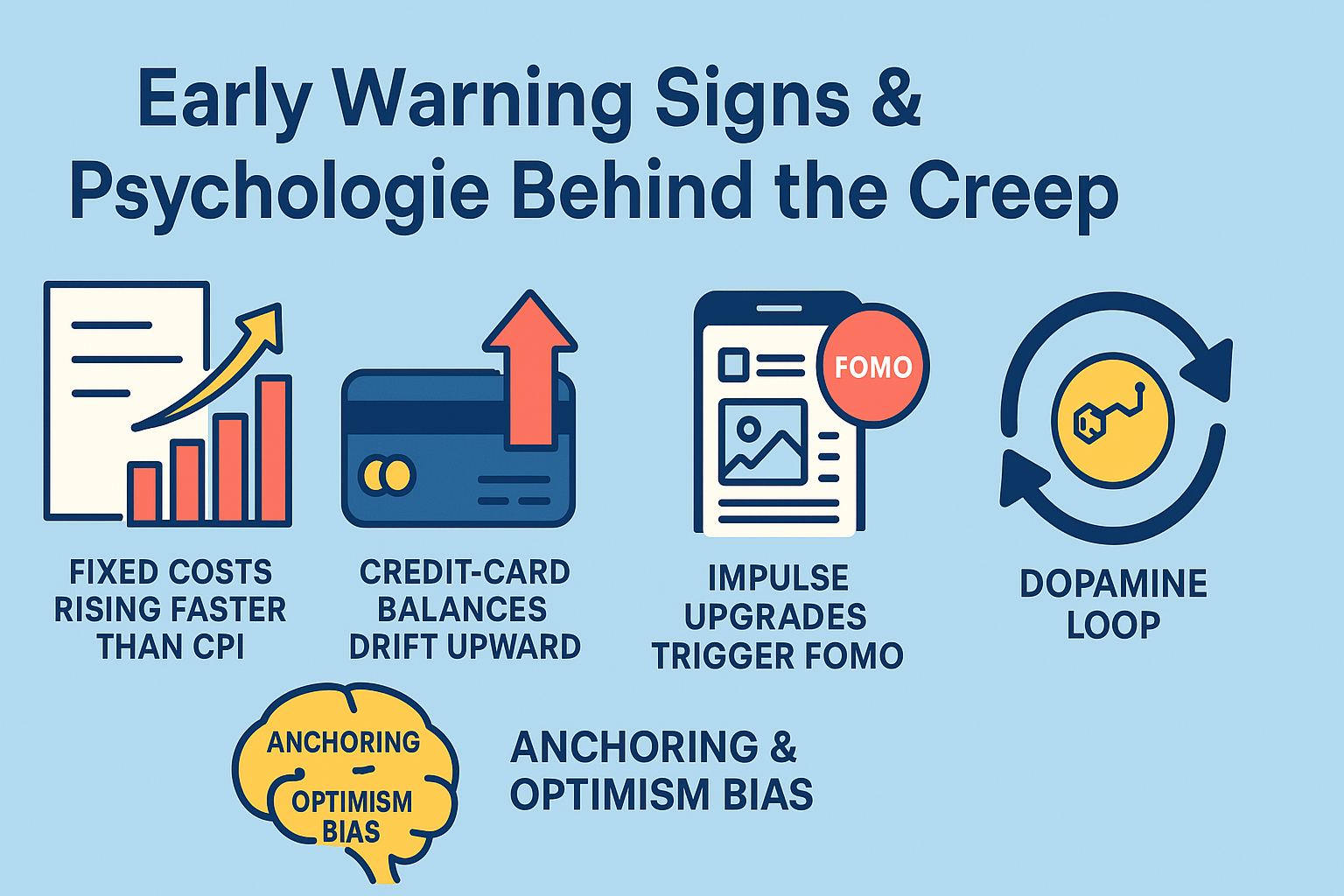

Early Warning Signs & Psychology Behind the Creep

One of the first indications that lifestyle inflation is taking root is when fixed costs begin rising faster than the Consumer Price Index (CPI). Essential expenses such as rent and EMIs escalate each year, often outpacing salary increases. When rent increases by 10% but your income only grows by 7%, that gap chips away at any surplus you once enjoyed. Over time, these mounting fixed obligations leave less breathing room in the budget, making it easier for discretionary expenses to consume every additional rupee.

Simultaneously, credit card balances can drift upward even after income jumps. When your monthly income grows, you might subconsciously justify charging a new smartphone or premium subscription, thinking, “I can afford it now.” However, if those charges aren’t paid off in full, interest starts accruing at high rates, prolonging debt and eroding any gains from a higher salary. The compounding interest on outstanding balances effectively negates the benefit of a raise, turning what should be a step forward into a sideways move.

Impulse upgrades are driven by social comparison, further fuelling lifestyle creep. In a world where social feeds constantly display curated snapshots of friends’ luxury vacations, new cars, or high-end gadgets, the fear of missing out (FOMO) magnifies the notion of “I deserve it”. Even a minor impulse purchase, like upgrading a coffee subscription or splurging on a premium fitness class, can trigger a cascade of spending. Before long, seemingly trivial upgrades start feeling essential, and discretionary budgets spiral out of control.

Psychology plays a central role in this cycle. According to Verywell Mind, two cognitive biases – anchoring and optimism bias – help normalise new spending habits. When you anchor on the idea that “everyone in my peer group uses this app”, it becomes easier to justify renewing a subscription you rarely use. Optimism bias leads you to believe that future paycheques will always cover these added costs, so you overlook the incremental impact. As these biases take hold, your mind resets expectations, and what once felt like a splurge becomes the new baseline.

Underlying these biases is the dopamine loop created by frequent, small purchases. Every time you buy a new pair of shoes or order a premium coffee, you experience a fleeting dopamine rush – an instant gratification that masks the long-term financial loss. These quick hits of pleasure encourage you to repeat the behaviour, making it harder to pause and evaluate whether each purchase truly aligns with your goals. Over time, the accumulation of minor, impulsive buys adds up, leaving you with a cluttered bank statement and minimal progress toward wealth accumulation.

Best Tools & Apps to Stay on Track

Effectively counteracting lifestyle inflation requires the right mix of budgeting, automation, and habit-building tools. The following table outlines key apps and platforms that can help you stay disciplined and aligned with your financial objectives:

| Need | App / Tool | Key Feature |

|---|---|---|

| Budgeting | YNAB / Monarch Money | Zero-based envelopes & goal progress |

| Automation | Auto-Sweep via bank | Same-day split to savings/investments |

| Spend Delay | Qube Money | Digital “cash-stuffing” to curb impulse |

| Habit-Building | Todoist / Notion | Recurring “money date” checklists |

| Subscription Audit | Truebill / CRED | Cancels, renegotiates, tracks bills |

When integrating these tools, it’s helpful to link internally to Budgeting 101 and Emergency Fund Calculator for seamless reader flow. Embedding those resources ensures that users can immediately apply practical strategies, whether they’re setting up a zero-based budget in YNAB or calculating the exact size of a liquid buffer in a debt fund account.

FAQs (People Also Ask) {#faqs}

Is lifestyle inflation ever good?

Sometimes, yes, modest quality-of-life upgrades can boost happiness if your savings rate stays on track and debt remains zero.

What percentage of my raise should I save vs spend?

Aim for 50% saved, 30% invested, and 20% enjoyed. This keeps gratification high while compounding wealth.

How can I enjoy my money without sabotaging goals?

Budget joy-based line items. Pre-plan fun money; spontaneous splurges plummet.

Does lifestyle creep affect high earners differently?

Yes, larger incomes mask overspending. Without guardrails, expenses swell to meet paycheques.

What is the 50-30-20 rule, and does it still work in 2025?

It works as a baseline. Adjust for location, debts, and aggressive FIRE goals.

How often should I review my budget for lifestyle creep?

Quarterly check-ins catch drift early; annual deep-dives recalibrate goals.

Which apps help stop lifestyle inflation automatically?

YNAB, Monarch, Auto-Sweep, and rule-based SIPs shift cash to assets before you can spend it.

How do I reset if I’ve already inflated my lifestyle?

Step back to baseline. Freeze upgrades, refinance expensive debt, and redirect the freed cash to an emergency fund first.