If you’ve ever opened a credit report and felt your brain go, “nope”, you’re not alone. How to Read Your U.S. Credit Report (Without Freaking Out) is less about financial genius and more about using a calm system to turn a confusing document into simple decisions.

Here’s the thesis: your credit report is not a judgement. It’s a data file—sometimes messy—used to predict risk. When you read it the right way, you can catch errors, prevent identity theft, and improve approvals for apartments, loans, and even certain jobs.

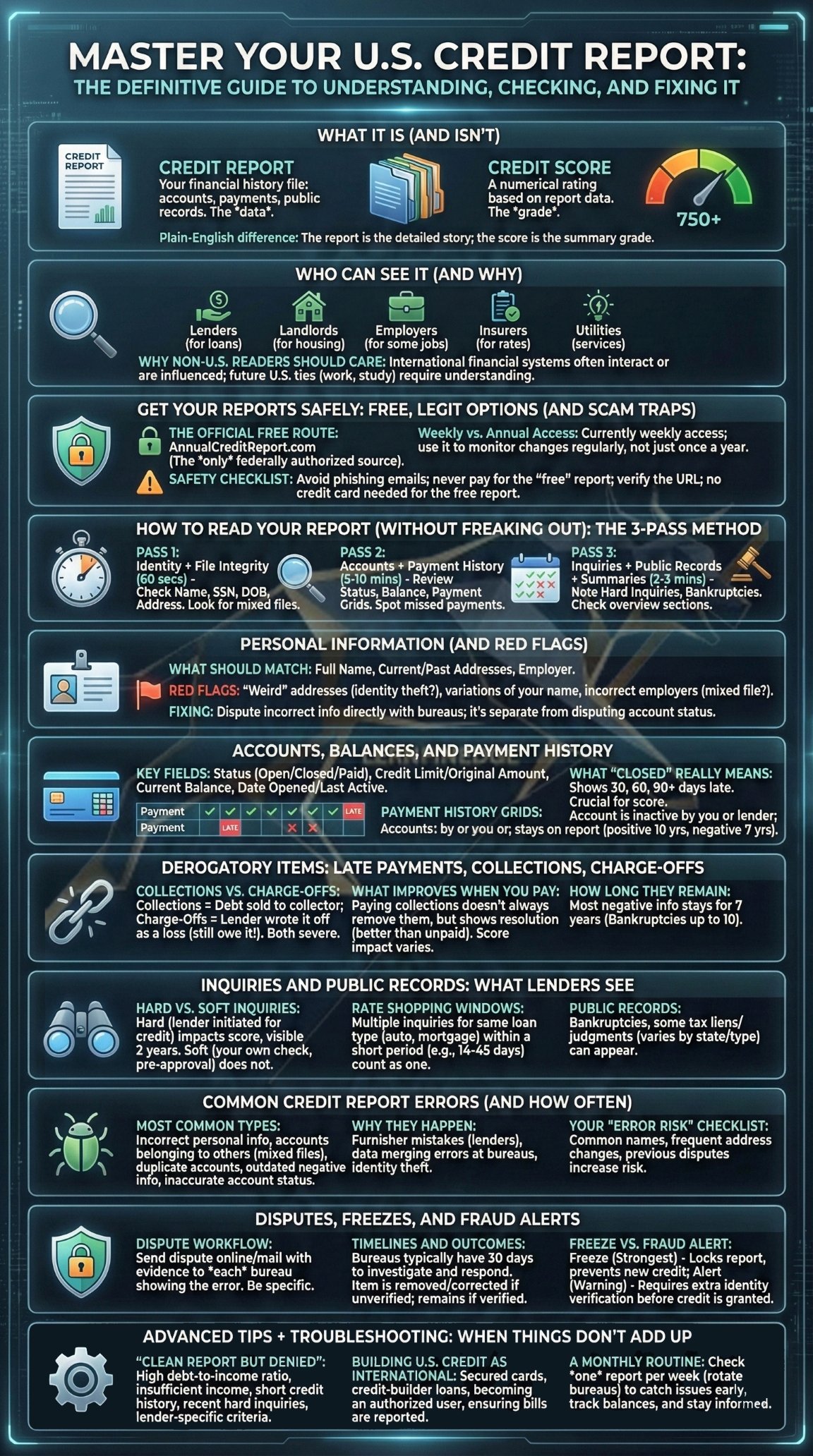

In my experience, the panic comes from trying to read everything at once. So we won’t. You’ll use a 3-Pass Method to scan the right sections in the right order, then take action only where it matters.

If you want a broader foundation that ties credit, budgeting, and debt together, start here: Money Basics: A Step-by-Step Playbook.

Quick Takeaway: Your credit report is a checklist, not a scoreboard. Review your credit report gradually, pinpoint any issues that are concerning, and take action to resolve them.

First, let’s understand what a U.S. credit report is. A credit report is (and isn’t)

Credit report vs credit score (plain-English difference)

A credit report is your credit history file: names, addresses, accounts, payment history, enquiries, and sometimes public records. A credit score is a number calculated from that file to predict risk. Think of the report as the ingredients and the score as the final dish.

Research shows consumers often chase scores without checking the report. That’s backwards. Fixing the report is how you fix the score—when the score is based on wrong data.

[Expert Quote placeholder]: “A credit score is only as accurate as the report behind it.”

Who can see it (and why)

Access to your consumer report is limited to specific permissible purposes (like lending, housing, and employment with consent). The key point: your report influences decisions even when you’re not thinking about credit.

Why non-U.S. readers should care.

If you are a global individual, such as an expat, international student, new immigrant, or remote worker, your U.S. credit reports hold significant importance. Credit reports can be important if you:

-

rent an apartment in the U.S.,

-

apply for a U.S. phone plan or utilities,

-

finance a car,

-

Seek specific job positions that require background checks.

Pro Tip (Expert Insight Box #1): If you’re moving to the U.S., build a “money stability buffer” early so you never miss payments. This pairs well with Emergency Funds: Build It Fast, Keep It Safe, Use It Right.

Quick Takeaway: The report is the source of truth. The score is just math applied to it.

Get Your Reports Safely: Free, Legit Options (and Scam Traps)

The official free-report route (what “free” really means)

In the U.S., you can access your credit reports from the three major bureaux through the official free-report process (and there have been periods where access was more frequent). The important part: use official channels, not ads or pop-ups.

Consider the wise use of either weekly or annual access.

Industry experts agree that the best approach is to use monthly access for quick scans of new accounts, new enquiries, and unusual address changes.

-

Monthly: quick scans for new accounts, new enquiries, and weird address changes.

-

Quarterly: deeper audit of accounts, balances, and payment history details.

-

Before major applications: full review 30–60 days before you apply.

This keeps you calm because you never find out late.

Safety checklist (phishing + lookalike sites)

Before entering personal info anywhere:

-

Use official channels (not a random ad).

-

Avoid links from emails/texts claiming, “Your score dropped.”

-

Use strong passwords and enable MFA where available.

-

Save PDFs locally only if your device is secure.

[Expert Quote placeholder]: “Treat your credit report like medical records—only access through official channels.”

Quick Takeaway: Obtain reports often, but read them strategically. You should perform quick scans frequently and occasionally conduct deep audits.

How to Read Your U.S. Credit Report (Without Freaking Out): The 3-Pass Method

Pass 1: Identity + file integrity (60 seconds)

Your first pass answers one question: Is this file truly mine and unmixed?

Check:

-

Name variations (fine if yours; suspicious if not)

-

Current and previous addresses (flag unknown)

-

Employer listings (often outdated; not usually critical)

-

Partial SSN display (should match your records)

If you see a completely unfamiliar identity element, your priority shifts to fraud defence (we’ll cover freezes and alerts later).

[Expert Quote placeholder]: “Most major credit disasters start as tiny anomalies—an address, a name variation, one unfamiliar account.”

Pass 2: Accounts + payment history (5–10 minutes)

Now scan the “Accounts” section (often called tradelines). You’re looking for:

-

Accounts you don’t recognize

-

Incorrect late payments

-

Wrong balances or limits

-

Duplicate accounts occur when the same debt is listed twice.

-

Wrong status (open vs closed)

This is the section that most affects approvals.

Pass 3: Inquiries + public records + summaries (2–3 minutes)

Finally, check:

-

Many inquiries you didn’t authorize

-

Excessive inquiries in a short time

-

Public record entries (if shown)

-

Collection agency entries

Analogy: Consider the three passes to be airport security:

-

Pass 1 checks your identity.

-

Pass 2: Check what you’re carrying (accounts).

-

Pass three checks on who accessed your file (enquiries).

Pro Tip (Expert Insight Box #2): If the process feels overwhelming, pair it with a simple weekly money routine so you’re never catching up. See 5-Minute Daily Money Habits.

Quick Takeaway: Don’t “read everything.” Run three passes. Flag issues. Then act.

How to Read Your U.S. Credit Report: Personal Information (and Red Flags)

What should match exactly

Your personal info section is not scored the same way accounts are, but it’s still important because errors can signal mixed files or identity theft.

Double-check:

-

Correct spelling of your legal name (variations are normal)

-

Current address accuracy

-

Date of birth consistency

-

Any partial ID numbers displayed

“Weird address” and mixed files

A strange address can be

-

an old address connected to an account,

-

a clerical error,

-

a sign someone used your identity.

The key is context. If a weird address appears alongside a new unknown account, treat it as high priority.

[Expert Quote placeholder]: “A wrong address isn’t always fraud—but it’s always a reason to look closer.”

Fixing personal information vs. disputing accounts

Some personal info updates can be corrected through the bureau, but if the personal info is tied to a fraudulent account, you may need to dispute the account first so the “source” of the incorrect data is removed.

Quick Takeaway: Personal info is your early-warning system. Unknown identity elements + unknown accounts = act fast.

How to Read Your U.S. Credit Report: Accounts, Balances, and Payment History

Key fields: status, limits, balances, dates

Most account lines include:

-

Account type: credit card (revolving) vs loan (instalment)

-

Date opened

-

Credit limit/original loan amount

-

Current balance

-

Account status: open, closed, charged off, in collections

-

Payment status can be current, or it may indicate that the account is 30, 60, or 90 days late, among other possibilities.

Payment history grids and late markers

Many reports show a monthly grid. Don’t stare at all months. Do this:

-

Look for any month marked late (30/60/90).

-

Please verify that the late month aligns with your records.

-

Examine whether the account later returned to “current”.

Case example:

You missed one payment in March due to travel, paid in April, and the account stayed current after. That’s a very different story than repeated late payments.

[Expert Quote placeholder]: “Lenders don’t just see ‘a late’. They see a pattern—your job is to verify the pattern is accurate.”

What “closed” really means (and what it doesn’t)

Many people panic at “Closed”. “Closed” can mean:

-

You closed it (fine).

-

The lender may have closed it, which can also be acceptable.

-

It was closed after delinquency (not fine).

Closed doesn’t automatically mean “bad”. Context matters.

Pro Tip (Expert Insight Box #3): A lot of credit damage starts with simple spending mistakes (utilisation, missed due dates, minimum-only traps). Link readers here: Money Mistakes to Avoid.

Quick Takeaway: Accounts are the core. Please verify the status, dates, limits, balances, and any late markers.

Derogatory Items: Late Payments, Collections, and Charge-Offs

Collections vs charge-offs (different problems)

A collection usually means a debt was turned over (or sold) to a collection agency. A charge-off typically means the lender classified the debt as a loss for accounting purposes—but collection can still happen.

They’re related, but not identical. Seeing both can mean:

-

The original creditor has reported a charge-off, and

-

A collector is reporting the collection.

That’s where duplicates can happen, and why careful reading matters.

[Expert Quote placeholder]: “Not all negative items are equal—some are reporting artefacts, others are genuine delinquencies.”

What improves when you pay (and what doesn’t)

Paying can help, but it depends on:

-

whether the account updates to “paid collection”,

-

whether the collector agrees to delete it (not guaranteed),

-

whether the late history remains.

Industry experts agree the most significant long-term lever is new positive history that outweighs older negatives.

How long can negative information remain?

As a general guideline, negative items can remain on a credit report for multiple years depending on the item type. What matters most is that the impact often fades as the item ages—especially when you add consistent positive history.

Quick Takeaway: Don’t panic—classify the negative item, confirm it’s accurate, then build a plan: fix errors, pay strategically, and rebuild positive history.

Inquiries and Public Records: What Lenders See

Hard vs soft inquiries (impact + visibility)

A hard enquiry usually occurs when you apply for credit. A soft enquiry is for checks like pre-approvals or when you check your own report.

Rate shopping windows (what to expect)

When you shop for a mortgage or auto loan, multiple enquiries may be treated differently by scoring models. The practical advice: do your rate shopping in a short, focused window—then stop applying.

If your audience is U.S.-based and buying a car, this is a strong internal supporting page: Budgeting for Car Ownership in the U.S.

[Expert Quote placeholder]: “Enquiries are like footprints—some are expected, but unexplained ones need attention.”

Public records (what might appear)

Some reports may display public record-related information depending on bureau data and reporting practices. If you see a public record entry you don’t recognize, treat it like a red-level item: verify it independently and dispute if inaccurate.

Comparison table: Hard inquiry vs soft inquiry (quick clarity)

| Feature | Hard Inquiry | Soft Inquiry |

|---|---|---|

| Trigger | Credit application | Precheck, background, self-check |

| Visible to lenders | Yes | Typically no (consumer-only) |

| Score impact | Possible small drop | None |

| How long it may show | Often up to ~2 years | Varies by type |

Quick Takeaway: Enquiries tell the story of who checked you. Unknown hard enquiry: investigate immediately.

Common Credit Report Errors (and How Often They Happen)

The most common error types

Here are the errors you’ll see again and again:

-

Accounts that aren’t yours (identity theft or mixed file)

-

Incorrect late payments

-

Wrong balance or credit limit

-

Duplicate reporting of the same debt

-

Incorrect account status (open/closed/charged off)

-

Personal data mismatches (addresses, names)

Why errors happen (furnishers, merging, identity theft)

Credit reporting is a pipeline: lenders/servicers furnish data, bureaux match it to you, then it appears in your file. Errors can happen at any step.

Research shows errors aren’t rare. [Source placeholder]

[Expert Quote placeholder]: “The goal isn’t perfect reporting—it’s early detection and fast correction.”

Your personal “error risk” checklist

You’re at higher risk of errors if you:

-

moved frequently,

-

have a common name,

-

changed your name,

-

recently immigrated,

-

were part of a data breach,

-

had medical or student loan servicing changes.

Quick Takeaway: Errors are common. That’s exactly why reading your report calmly is a power move, not a chore.

How to Read Your U.S. Credit Report: Disputes, Freezes, and Fraud Alerts

Dispute workflow (what to send, where, and how)

If something is wrong, you want a clean process:

-

Circle the exact line item that’s incorrect (account number partial, dates, amounts).

-

Gather proof: statements, payoff letters, identity documents, and an identity theft report if relevant.

-

Dispute with the bureau(s) showing the error (online or mail).

-

Dispute with the furnisher (the lender/collector) in parallel when appropriate.

[Expert Quote placeholder]: “Winning disputes is about precision: one claim, one proof, one outcome.”

Timelines and outcomes (what to expect)

Disputes often follow a defined investigation timeline, and you’ll generally get a written outcome.

Possible outcomes:

-

Deleted (best case for inaccurate items)

-

Corrected (dates, balances, status)

-

Verified (bureau claims it’s accurate)

-

Marked frivolous/irrelevant (if incomplete evidence)

Freeze vs fraud alert (which one fits)

A credit freeze can help stop new-account fraud by restricting access to your file, and a fraud alert signals lenders to verify identity more carefully.

Quick Takeaway: Dispute inaccuracies with evidence and clarity. Use freeze/alerts if identity risk is present or you want preventive control.

Advanced Tips + Troubleshooting: When Things Still Don’t Add Up

“My report is clean but I got denied” reasons

This happens more than people think. Common reasons:

-

The lender used a different bureau than the one you checked.

-

They relied on a different score model than the one you saw.

-

Your file is “thin” (not enough history).

-

Your income/debt profile fails their internal rules even with good credit.

Industry experts agree: always check all three bureau reports before major applications, not just one.

[Expert Quote placeholder]: “Approval is score + policy. A clean report helps, but lenders still apply their own rules.”

Building U.S. credit as an international/immigrant (worldwide audience)

If you’re new to the U.S., your early wins usually come from:

-

secured credit cards,

-

being added as an authorized user (carefully),

-

paying on time consistently,

-

keeping utilisation low.

To connect this to a broader “build wealth” journey (for your site’s funnel), use:

Your First 5 U.S. Investments for Beginners

A monthly credit routine that prevents surprises

Use a simple schedule:

-

Monthly (5 minutes): Pass 1 + Pass 3 scans (identity + enquiries).

-

Quarterly (15 minutes): Full 3-pass method.

-

Pre-application (30–60 days ahead): Dispute and stabilise.

If readers need help creating the system behind that routine, link:

How to Budget Money in 5 Steps and Budgeting Tips: A Practical Playbook.

Quick Takeaway: If denial feels confusing, assume model/bureau mismatch or policy rules. Then verify systematically.

Conclusion: Your 15-Minute Monthly Credit Report Routine

The routine (monthly/quarterly)

Here’s your calm plan:

-

Monthly: Scan for new accounts, unknown enquiries, and identity changes.

-

Quarterly: Review all accounts, payment markers, balances, and duplicates.

-

Before applying: Confirm all three reports are aligned and accurate.

This is how you stop credit from becoming a surprise.

[Expert Quote placeholder]: “The best credit strategy is boring consistency—check, verify, correct, repeat.”

The “before you apply” checklist

Before a mortgage, apartment, or major loan:

-

Pull reports from all three bureaux.

-

Dispute any clear inaccuracies immediately.

-

Avoid new applications unless necessary.

-

Consider a temporary freeze lift window if your credit is frozen.

Next steps (CTA)

If you do one thing today, pull your reports, run the 3-Pass Method, and mark your red items. Then fix only what matters.

For readers who need the “supporting habits” that keep credit strong over time, send them to:

Final Quick Takeaway: Reading your U.S. credit report isn’t scary—it’s a skill. And once you have the method, you’ll never feel lost again.