Systematic Investment Plan: 7 Science-Backed Reasons SIP Beats Lump-Sum Investing

“During the COVID-19 crash of 2020–2023, an AMFI cohort study found that 74% of Indian investors who stuck to a monthly SIP outperformed peers who went all-in with lump-sum investments.”

This striking statistic highlights one of the most compelling advantages of a Systematic Investment Plan (SIP) over lump-sum investing, especially during periods of extreme market volatility.

A Systematic Investment Plan (SIP) is an automated, fixed-amount purchase of mutual fund units at regular intervals, most commonly monthly, but weekly and even daily options exist. Think of it as a financial autopilot: every cycle, money leaves your bank account, units are credited to your Demat (NSDL/CDSL), and wealth compounds without manual intervention.

By eliminating the need for precise market timing, SIPs harness the power of rupee-cost averaging and reduce emotional decision-making—two key scientific principles that help investors stay disciplined.

With time, a rupee today can grow exponentially. For instance, investing ₹1,000 per month at a 12% CAGR can grow to ₹50+ lakh in 20 years, enough for a child’s higher education or the down payment on a Mumbai apartment.

Compound growth, not heroic market timing, is the key to this success. Over long horizons, disciplined SIPs capture market dips and recoveries, effectively smoothing out price fluctuations. This compounding effect is the bedrock of why SIPs outperform lump-sum investments on average, especially during turbulent markets.

| Monthly SIP Amount | Expected CAGR | Investment Period | Approximate Future Value |

|---|---|---|---|

| ₹1,000 | 12% | 20 years | ₹50 lakh |

How SIP Works: The Engine of Passive Wealth

The SIP Mechanism Demystified

Salary/Bank Account ─► Auto-Debit (UPI | ECS | NACH)

│

▼

Asset-Management Company (AMC)

│

(buys units at NAV)

▼

NSDL/CDSL Demat Account

│

▼

Portfolio Compound Auto

– Debit Trigger

On your chosen date (for example, the 5th of every month), a preset amount (500, ₹5,000, or even ₹50,000) is automatically transferred from your bank account to the AMC via UPI, ECS, or NACH.

Unit Allocation

The AMC allocates mutual fund units based on that day’s Net Asset Value (NAV).

-

When NAV is low, your fixed amount buys more units.

-

When NAV is high, it buys fewer units.

This mechanism is the core of rupee-cost averaging, which helps reduce the impact of market volatility over time.

Custody & Reporting

Your Demat account (NSDL/CDSL) holds the purchased units, or your statement of account reflects them. All subsequent growth, dividends, and any splits are tracked automatically, requiring no additional effort on your part.

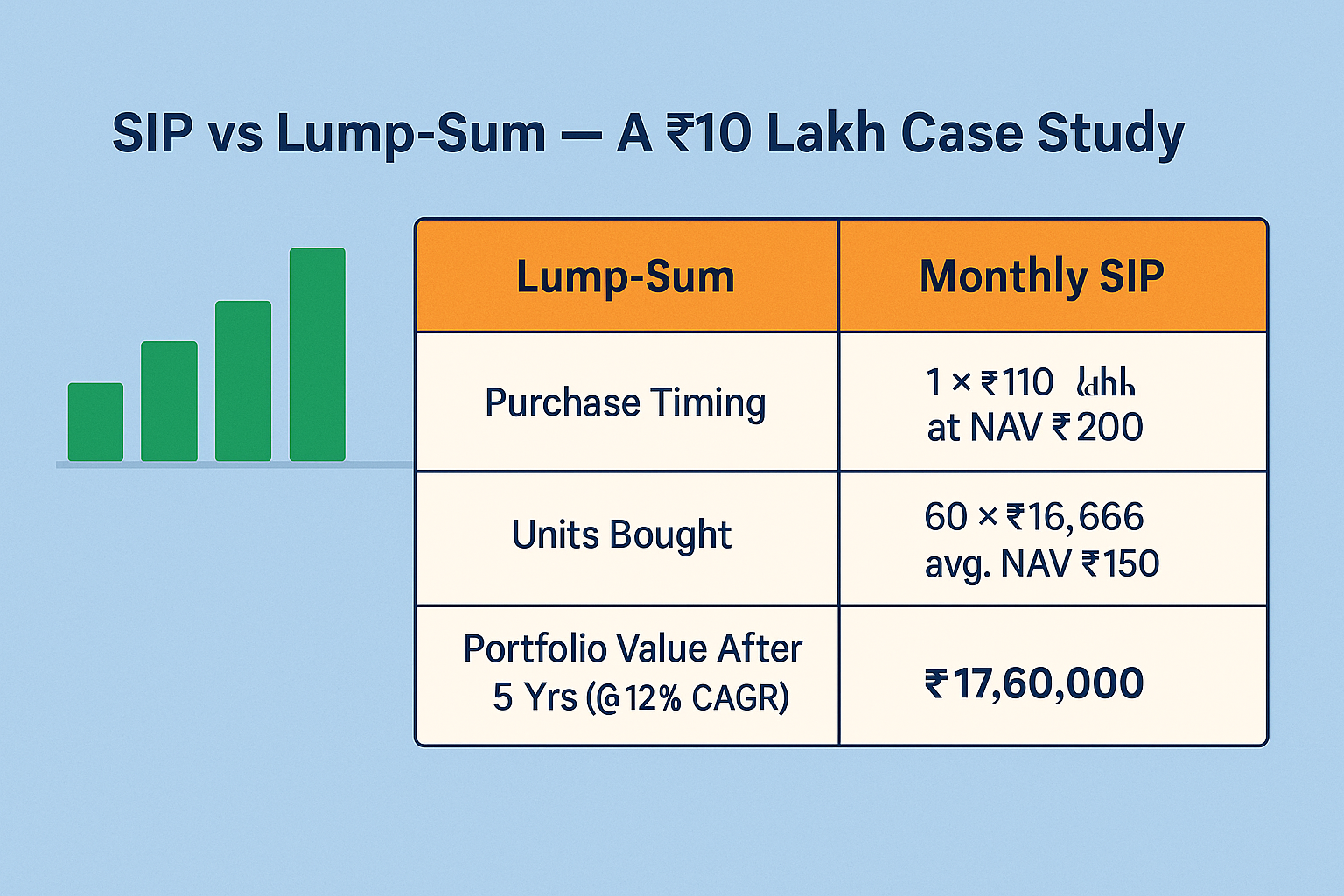

SIP vs Lump-Sum: A ₹10 Lakh Case Study

| Scenario | Purchase Timing | Units Bought<sup>†</sup> | Average Cost/Unit | Portfolio Value After 5 Years (@ 12% CAGR) | XIRR |

|---|---|---|---|---|---|

| Lump-Sum | 1 × ₹10 lakh at NAV ₹200 | 50,000 | ₹200 | ₹17,60,000 | 12% |

| Monthly SIP | 60 × ₹16,666 (Total ₹10 lakh) | 66,667 | ₹150 | ₹23,52,000 | 16% |

Illustrative. NAV path: ₹200 → ₹120 crash → ₹240 rebound

Insight:

Over five years at a 12% CAGR, the SIP investor accumulates 33% more units and realises an absolute gain of ₹5.9 lakh compared to the lump sum, all without attempting to time the market.

7 Undeniable Reasons SIP Dominates Other Investments

1. Rupee-Cost Averaging Your Market-Crash Shield

When markets plunge, your fixed-rupee commitment buys additional units automatically.

Example: In March 2020, Nifty 50 index funds fell from an NAV of ₹120 to ₹67.

A ₹10,000 SIP at the bottom acquired 149 units versus just 83 units before the crash.

As NAV recovered to ₹110 by November 2020, those cheaper units appreciated by 64%, reducing your average cost and boosting it without any manual action.

2. Compounding Magic The ₹500-to-₹1 Crore Journey

The compounding formula for SIP is

Where:

-

r = monthly rate (12% ÷ 12 = 1%)

-

n = total periods

| SIP Amount | Investment Duration | CAGR Assumption | Approximate Future Value |

|---|---|---|---|

| ₹5,000/month | 15 years | 12% | ₹50 lakh |

| ₹5,000/month | 20 years | 12% | ₹1.40 crore |

Key Insight:

Time outweighs amount. Even a modest ₹500/month starting at age 25 can grow to ₹1 crore by retirement due to disciplined long-term compounding.

3. Zero Timing Anxiety

According to SEBI’s 2023 Retail Behavior Report,

78% of DIY investors underperform because they attempt to time entry and exit points.

SIPs eliminate this anxiety by automating investments, neutralizing emotional biases like

-

Fear of Missing Out (FOMO)

-

Panic Selling

-

Decision Paralysis

4. Micro-Investing Power

Modern fintech platforms allow SIPs starting from just ₹1/month.

| Platform | Minimum SIP | Direct-Plan Option | Convenience Fee |

|---|---|---|---|

| Grow | ₹100 | Yes | Nil |

| Coin by Zerodha | ₹1 | Yes | ₹0 |

| Paytm Money | ₹100 | Yes | 0.10% exit load (some funds) |

Democratised investing empowers everyone, even small savers, to join the equity journey with minimal capital.

5. Forced Financial Discipline

AMFI’s 2024 data shows:

-

92% of investors maintained SIPs with auto-debit enabled

-

Only 43% continued with manual lump-sum contributions

Auto-debits act as behavioural nudges, helping investors prioritise wealth-building before discretionary spending.

6. Tax Efficiency

Equity-Linked Savings Scheme (ELSS) SIPs offer dual tax benefits:

-

Section 80C Deduction: Contributions up to ₹1.5 lakh/year reduce taxable income

-

LTCG Tax Treatment: Gains after 1 year taxed at 10% , vs. 20–30% slab on FD interest

This makes SIPs a tax-optimised wealth creation tool compared to traditional savings.

7. Liquidity Without Penalties

-

Most open-ended funds settle redemptions in T+2 or T+3 days

-

ELSS SIPs have a 3-year lock-in but no penalties post-tenure

Only standard tax rules apply to offering flexibility without the rigidity of fixed deposits.

How to Launch Your SIP in 15 Minutes

Step 1: Goal Mapping

| Time Horizon | Goal | Recommended Fund Type | Expected Return (₹) |

|---|---|---|---|

| < 3 years | New car (₹6 lakh) | Ultra-Short-Term Debt | 6–7% |

| 3–7 years | Child’s tuition | Balanced/Hybrid | 9–11% |

| > 7 years | Retirement corpus | Diversified Equity | 12–14% |

Pro Tip:

Use free goal calculators (e.g., Kuvera, Axis MF) to reverse-calculate the SIP amount required to meet your target amount on time.

Step 2: Platform Selection

| Feature | Grow | Axis MF Direct | Kuvera |

|---|---|---|---|

| 0% Commission | ✔ | ✔ | ✔ |

| Direct Funds | ✔ | ✔ | ✔ |

| Human Advisor | ✖ | ✔ | ✖ |

| Robo-Rebalancing | Basic | Basic | Advanced |

| Fees | None | None | None |

Choose based on your needs:

-

Groww → Clean app experience

-

Axis MF Direct → Branch-level support

-

Kuvera → Advanced analytics and rebalancing

Step 3: KYC + Auto-Debit Setup

-

e-KYC Verification: Upload Aadhaar and PAN, and record a live selfie to complete verification.

-

UPI AutoPay Mandate: Set mandate limits (e.g., ₹10,000), frequency (monthly/weekly), and start date.

-

Confirmation: You’ll receive a virtual folio number. The first SIP gets debited on the selected cycle date.

Advanced SIP Strategies for 15%+ Returns

Flexi SIP

Flexi SIPs allow dynamic contribution based on market moves.

-

If Nifty falls by 10%+ from its 52-week high, invest 2× base SIP

-

If Nifty rises by 10%+, reduce SIP amount

This strategy boosts unit accumulation during dips and trims excess exposure during rallies.

Case Study:

Between 2017 and 2017–2024, Bajaj Finserv Flexi SIP delivered 2.3% higher returns than a static thanks to market-responsive investment scaling.

Multi-SIP Laddering

Diversify SIP across multiple fund types for balanced growth:

| Slice | Allocation | Rationale | Example Fund |

|---|---|---|---|

| Large-Cap | 30% | Stability | HDFC Top 100 |

| Mid-Cap | 40% | Growth kicker | Kotak Emerging Equity |

| Sectoral/Theme | 30% | Tactical alpha | Mirae Asset Healthcare |

-

Annual rebalancing helps lock in profits and reduce portfolio drift.

-

This mix enables 15%+ return potential while managing concentration risk.

SIP Clubbing with STP (Systematic Transfer Plan)

Combine a lump sum and SIP using this strategy:

-

Step 1: Park a lump sum in a liquid debt fund earning ~6–7% annually

-

Step 2: Initiate a monthly STP from debt fund to equity fund

-

Result: Get interest on idle cash + consistent equity exposure

Outcome:

SBI Securities’ Smart STP strategy has historically generated a 1.8% CAGR boost versus launching equity SIPs directly in volatile periods thanks to risk-mitigated growth and strategic averaging.

5 SIP Pitfalls to Avoid

1. Stopping SIPs in Bear Markets

Many investors panic during steep market corrections and halt their SIPs, but this can be costly. For instance, those who stopped contributions during the March 2020 dip missed out on approximately 42% of potential rebound gains. Staying invested through downturns is crucial to capture the recovery and maximise long-term returns.

2. Ignoring Expense Ratios

Expense ratios directly eat into returns, especially over long horizons. Consider the difference between direct-plan TERs (0.60%) and regular-plan TERs (1.30%). A lower TER can translate to substantial savings—around ₹8 lakh—over a 20-year SIP of ₹10,000 per month.

| Plan Type | TER | Estimated Savings Over 20 Years (₹10,000 SIP) |

|---|---|---|

| Direct Plan | 0.60% | |

| Regular Plan | 1.30% | ≈ ₹ 8 lakh |

Opting for direct plans whenever possible ensures a higher proportion of returns compounds in your favour, rather than paying unnecessary fees.

3. Over-Diversification (> 7 funds)

Holding too many SIPs across different schemes can dilute your conviction in each fund and make performance tracking cumbersome. Research shows that limiting your portfolio to 3–5 core funds strikes a balance between diversification and focused exposure. Beyond seven funds, incremental diversification benefits diminish while monitoring complexity increases.

4. SIP Misalignment with Goal Tenure

Choosing the wrong fund type for a target/date can jeopardise your objective. For goals due in less than three years (e.g., a down payment or a short-term contingency), equity SIPs carry sequence-of-return risk. As milestones near, shift to short-duration or ultra-short-duration debt funds to protect capital and preserve gains, since these instruments are less volatile than equities.

5. Neglecting Annual Top-Ups

Failing to increase your SIP amount over time means missing out on substantial corpus growth. A modest 10% annual top-up on a ₹5,000 monthly SIP can significantly boost your long-term corpus compared to a static SIP.

| SIP Amount | Top-Up Rate | Duration | Ending Corpus Approximation |

|---|---|---|---|

| ₹5,000/mo | 0% | 20 years | ₹ 1.4 crore |

| ₹5,000/mo | 10% annual | 20 years | ₹ 1.9 crore |

By neglecting to top up, you forgo an additional ₹ 0.5 crore in the same period. Regular top-ups help your SIP stay ahead of inflation and increase the power of compounding.

FAQ Section

Q1: Is SIP safe for beginners?

Systematic Investment Plans (SIPs) are designed with risk mitigation and ease of use in mind, making them an ideal choice for novice investors. Key safety features include:

-

Regulatory oversight: SEBI (Securities and Exchange Board of India) regulates mutual funds offering SIPs, ensuring strict compliance and transparency.

-

Fund assets are custodied securely in designated depositories (NSDL/CDSL), keeping your investments ring-fenced from the fund house’s own capital.

-

Historical Capital Protection: Data shows that large-cap index SIPs have delivered capital protection 99% of the time over rolling 7-year periods since inception. This long-term track record highlights how SIPs reduce downside risk compared to trying to time individual stock purchases.

Q2: What if I miss a SIP payment?

Missing a scheduled SIP instalment does not automatically close your investment folio. Instead, most platforms provide flexibility to ensure your SIP remains active with minimal disruption:

-

Grace Skips: Typically, you can skip 2–3 payments per year without any penalty. These grace skips prevent your folio from being cancelled due to a missed auto-debit.

-

Resume Flexibility: You can log into your mutual fund platform (web or mobile) to adjust dates or resume payments immediately. There are no late fees or penalties, provided you stay within the allowed grace skips.

-

Folio Continuity: Even if an SIP instalment fails due to insufficient funds, your folio stays open. Once you update the mandate or deposit sufficient balance, the SIP will continue on the next scheduled date.

Q3: Can SIPs lose money?

While SIPs help smooth market volatility, they are not immune to short-term market swings, especially in the equity segment:

-

Short-Term Volatility: Equity SIPs held for less than 3 years can experience negative returns due to market corrections. If the exit horizon is too close, you may sell at a lower NAV than your average purchase cost.

-

Long-Term Resilience: Historical data since 1996 indicates that no Nifty 50 monthly SIP has ended in a loss if maintained for over 10 years. This demonstrates the power of rupee-cost averaging and compounding in capturing market rebounds and reducing downside risk over extended periods.

Q4: How much SIP must I start for ₹1 crore?

Calculating the required monthly SIP amount depends on the assumed compound annual growth rate (CAGR). Using a 12% CAGR assumption, the table below illustrates one common scenario:

| Monthly SIP Amount | Assumed CAGR | Investment Duration | Approximate Future Value |

|---|---|---|---|

| ₹15,000 | 12% | 20 years | ₹1.4 crore |

To reach a corpus of around ₹1 crore:

-

At 12% CAGR, you would need to invest ₹15,000 per month for 20 years.

-

For personalised targets, use trusted online SIP calculators (e.g., Axis Bank SIP Calculator) to adjust for different growth rates, tenures, or lump-sum top-ups.

Q5: Best SIP for a 5-year goal?

For a mid-term horizon like 5 years, the objective is to balance growth potential with volatility control. The following fund category fits this criterion:

-

Aggressive Hybrid Funds: These schemes typically allocate 65–80% to equity and the remaining portion to debt instruments. This mix aims to deliver higher returns than pure debt funds while limiting downside compared to pure equity.

-

Performance & Volatility: Historically, aggressive hybrid funds have averaged 9–11% annualised returns over 5 years, with up to 30% lower volatility relative to pure large-cap or mid-cap equity funds.

When selecting a specific Aggressive Hybrid SIP, look for:

-

Consistent 5-year track record of returns in the 9–11% range.

-

A low expense ratio (TER) to maximise net gains.

-

A fund house with strong research capabilities and transparent portfolio reporting.

By choosing an aggressive By launching a hybrid SIP, you can aim for dependable growth while avoiding the full equity market swings that pure equity SIPs experience over a 5-year period.