Emergency Funds Challenge: Save $1,000 in 30 Days - Jump‑Start Your Safety Net

Imagine waking up to a flat tire, a chipped tooth, or a daycare closure that forces you to miss work. Life’s little crises do not wait for payday, and they never ask whether you are ready. That is why emergency funds matter. An emergency fund is a cash buffer you can reach within minutes, providing peace of mind and sparing you from debt when the unexpected strikes. This friendly, step‑by‑step guide shows you how to pile up one thousand dollars in just thirty days. You will track every dollar, shrink waste, spark fresh income, and lock your first‑line safety net. By the end of the month you will not only have cash in the bank but also a toolkit of habits you can use forever.

Why a $1,000 Starter Fund Matters

A full emergency fund is typically three to six months of living costs, yet that target can feel distant when your balance hovers near zero. A one‑thousand‑dollar starter fund offers three superpowers:

-

Psychological momentum

The first thousand prove that change is possible. It flips your self‑image from “I cannot save” to “I am a saver”. That confidence fuels bigger goals. -

Real‑world protection

One grand covers many common surprises: new brakes, a vet bill, or a last‑minute flight to visit family. Reaching for savings instead of a credit card prevents debt’s snowball. -

Breathing room for bigger plans

With an emergency cushion, you can attack high‑interest debt, invest for retirement, or pursue career moves without constant panic. The fund does not solve every problem, but it buys you time to solve them yourself.

How the 30-Day Challenge Works

The 30-day challenge is simple but rigorous. Think of it as a personal finance boot camp with three standing orders and a weekly game plan.

The Three Daily Rules

-

Track every dollar

Each morning, note yesterday’s income and spending. Use a notebook, spreadsheet, or free app. Tracking is the compass that guides every other move. -

Only buy essentials

Food, shelter, medicine, utilities, and work transport stay. Restaurant meals, impulse online buys, and subscriptions you forgot to cancel go on pause. -

No dining out

Home‑cooked meals can save hundreds in a single month. If cooking feels daunting, batch‑prep simple staples on Sunday: rice, pasta, roasted veggies, and protein.

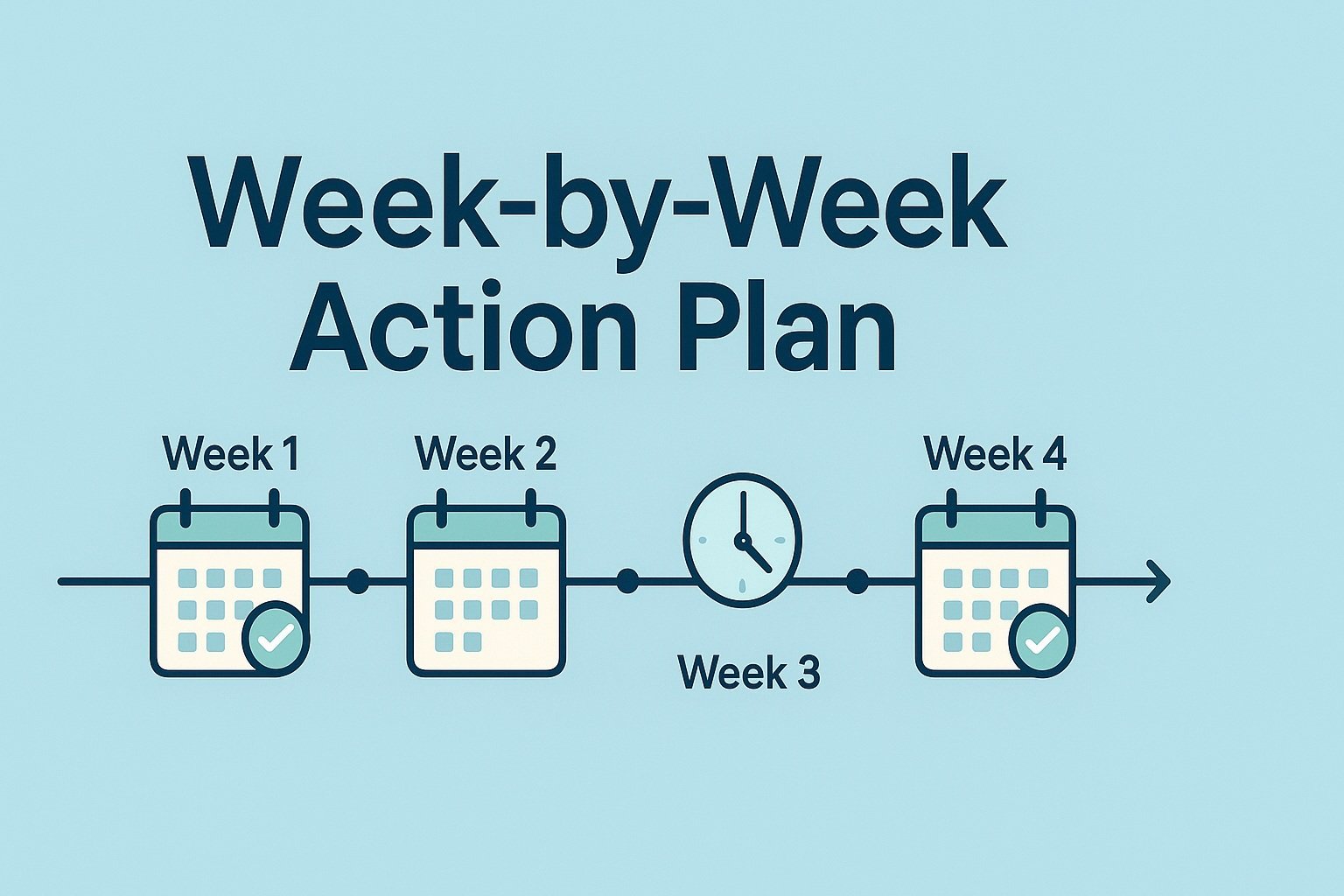

Your Four‑Week Roadmap

| Week | Theme | Target Savings |

|---|---|---|

| 1 | Slash Non‑Essentials | $250 |

| 2 | Earn Extra Cash | $300 |

| 3 | Optimize Bills & Subscriptions | $250 |

| 4 | Sell & Celebrate | $200 |

Caption: This high‑level roadmap breaks a big goal into weekly chunks so you know exactly what to aim for.

Totals add up to one thousand dollars, but you might surpass them if you catch momentum. Ready? Let’s prep.

Prep Day: Set Up for Success

Open a Dedicated High-Yield Savings Bucket

Park your emergency dollars in a separate, interest‑bearing account. Separation stops you from “accidentally” spending the money, and a competitive annual percentage yield helps the cushion grow quietly. Choose an online bank with no monthly fees, immediate transfers, and FDIC insurance. Label the account Emergency Funds so the purpose stays front and centre.

Audit the Last 30 Days of Spending

Pull bank and credit statements for the previous month. Highlight every nonessential: streaming subscriptions, grab‑and‑go coffee, impulse apps, unused gym memberships, fashion splurges, and late‑night delivery fees. Tally them. Most people uncover hundreds of dollars hiding in plain sight. That total shows where Week 1 savings will come from.

Pick One Fast Side Hustle

Side income supercharges progress. Choose a hustle you can launch within 48 hours:

-

Gig driving (rideshare or food delivery)

-

Task apps (moving, cleaning, assembling furniture)

-

Freelance micro‑jobs (editing, graphic design, data entry)

-

Pet sitting or dog walking

-

Weekend event staffing

Commit to a realistic schedule: for example, two evening shifts and one long weekend block. Even $75 extra per week moves the needle.

Week‑by‑Week Action Plan

Week 1: 7 Expense‑Cut Challenges

-

No‑Spend Sprint (Mon‑Wed)

Buy groceries beforehand and spend zero discretionary dollars for three days straight. -

Meal‑Prep Marathon (Sunday)

Cook large batches of versatile dishes. Freeze portions to resist takeout temptation. -

Cancel One Subscription

Nix any streaming or app you barely use. Savings: $10‑$20 monthly. -

Commute Hack

Carpool, bike, or use public transit two days. Pocket the gas or parking money. -

Grocery Swap

Replace brand‑name staples with store brands for the week. -

Energy Audit

Unplug vampire electronics and lower the thermostat by two degrees. -

Library Swap

Borrow ebooks, audiobooks, movies, and board games instead of buying entertainment.

Complete all seven, and you should clear roughly $250.

Week 2: 7 Income‑Boost Challenges

-

Two Gig Shifts

Drive, deliver food, or run tasks. Average earnings: $50‑$100 per shift. -

Sell Unused Tech

Post an old phone, tablet, or console on a local marketplace. -

Weekend Freelance Blitz

Offer a service you are good at on Fiverr or Upwork. -

Tutoring Session

Help a student in math, English, or music for cash. -

Yardwork or Handy Help

Rake leaves, mow lawns, or assemble furniture via neighbourhood boards. -

Survey Stack

Knock out well‑paying online surveys while watching TV. -

Cash‑Back Apps

Use receipt‑scanning and shopping portals to earn bonuses.

Combine two or three, and $300 is well within reach.

Week 3: Bill‑Bust & Automate

-

Negotiate Insurance

Call auto and renters insurers. Compare quotes; many match lower offers. -

Downgrade Phone Plan

Switch to a light‑data plan or a prepaid carrier. -

Refinance or Consolidate Debt

Lower interest frees up monthly cash. Apply any reduction straight to the emergency account. -

Slash Utility Waste

Install LED bulbs, seal drafts, and wash clothes on cold. -

Subscription Purge

Recheck statements for sneaky recurring fees. Cancel ruthlessly. -

Automatic Transfers

Set daily or weekly auto‑moves of the freed‑up amounts into the emergency bucket. -

Celebrate Free Fun

Plan a movie night at home, a picnic, or a hike instead of paid entertainment.

Expected savings: $250.

Week 4: Monetize & Future-Proof

-

Host a Mini Yard Sale

Clear closets. Price low for quick sales. -

Sell Collectibles or Designer Items

Use niche platforms for higher-value goods. -

Refer‑a‑Friend Bonuses

Many apps and services pay cash for referrals. -

Cash in Reward Points

Convert credit card or loyalty points to statement credits or gift cards, then bank the cash you would have spent. -

Use Cash‑Back On Groceries

Shop through rebate apps; transfer cash‑back to savings. -

Set Recurring Transfer Beyond Day 30

Protect the momentum. A small weekly auto‑deposit keeps the fund climbing. -

Reflect and Reset Goals

Review the month. Note wins and challenges; plan the next tier of targets.

Total Week 4 goal: $200.

Lock It In & Level Up

From $1k to 3–6 Months’ Expenses

Your Emergency Funds starter cushion is alive and well, but storms bigger than a flat tire still exist. Multiply your average monthly expenses by three for a minimalist buffer and by six for a sturdier one. Continue the habits that felt easiest: weekly meal prep, side hustle shifts, or auto‑saving percentages of each pay cheque. Every dollar above one thousand accelerates your move from financial fragility to resilience.

Keep the Habits Alive (monthly mini‑challenges)

-

No‑Spend Weekend: Pick one weekend per month to spend zero discretionary dollars.

-

Gig Blitz: Choose one high‑earning weekend per quarter and dedicate it to side work.

-

Subscription Audit: Revisit recurring charges every ninety days.

-

Bill Check‑In: Call one provider each quarter to ask about new customer promos.

-

Savings Level‑Up: Each time you get a raise, route half of the increase to emergency funds automatically.

FAQ

Is $1,000 enough for an emergency fund?

A thousand dollars is a starter cushion. It shields you from many common surprises and keeps small crises off your credit card. After reaching this milestone, aim for three to six months of living costs.

How can I save $1,000 in 30 days?

Follow the four‑week roadmap above: slash non‑essentials, ignite side income, optimise bills, and sell unused items. Track every dollar and automate transfers to lock savings in place.

Where should I keep my emergency fund?

Store it in a liquid, FDIC‑insured high‑yield savings account or money‑market account. Avoid investment accounts that can drop in value or require days to access.

What counts as a real emergency?

True emergencies are unavoidable, time‑sensitive expenses that protect health, housing, or essential transportation. Routine bills, vacations, and sale shopping do not qualify.

What if I am living pay cheque to pay cheque?

Start small: a ten- or twenty‑dollar transfer, selling one unused gadget, or cancelling one subscription. Momentum builds quickly when you see progress, and every micro‑win moves you closer to the first thousand.

Completing the 30-Day Emergency Funds Challenge proves you can flip your financial script fast. Bank that first grand, keep the habits rolling, and let your growing cash cushion whisper the same powerful phrase every day: I have options.